Page 18 - awe30062_compressed

P. 18

Diahuebs 30 di Juni 2022

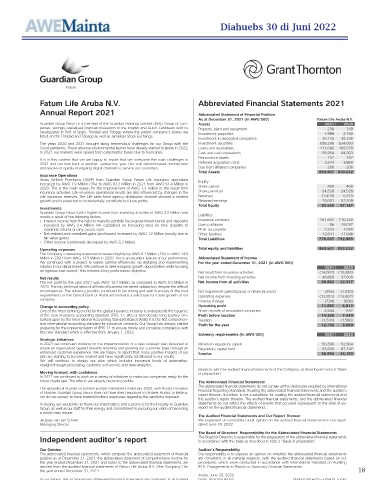

Fatum Life Aruba N.V. Abbreviated Financial Statements 2021

Annual Report 2021 Abbreviated Statement of Financial Position

As at December 31, 2021 (In AWG’000) Fatum Life Aruba N.V.

Guardian Group Fatum is a member of the Guardian Holdings Limited (GHL) Group of com- Assets 2021 2020

panies, strongly capitalized financial institutions in the English and Dutch Caribbean with its Property, plant and equipment 236 349

headquarter in Port of Spain, Trinidad and Tobago where the parent company’s shares are Investment properties 1,998 2,150

listed on the Trinidad and Tobago as well as Jamaican Stock Exchange.

Investment in associated companies 38,134 38,336

The years 2020 and 2021 brought along tremendous challenges for our Group with the Investment securities 656,296 634,093

Covid pandemic. These adverse environmental factors have already started to abate in 2022. Loans and receivables 111,682 105,978

In 2021 our markets were spared from catastrophic losses due to hurricanes. Cash and cash equivalents 56,954 44,303

Reinsurance assets 757 757

It is in this context that we are happy to report that we overcame the main challenges in

2021 and can look back at another satisfactory year. Our staff demonstrated commitment Deferred acquisition costs 3,244 3,860

and resolve in quickly instigating digital channels to service our customers. Due from affiliated companies 206 206

Total Assets 869,507 830,032

Insurance Operations

Gross Written Premiums (GWP) from Guardian Group Fatum Life insurance operations Equity

increased by AWG 1.9 Million (3%) to AWG 63.3 Million in 2021 from AWG 61.4 Million in Share capital 400 400

2020. This is the main reason for the improvement of AWG 1.3 million in the result from

insurance activities. Life insurance operational results are also influenced by changes in the Share premium 24,528 24,528

Life insurance reserves. The Life sales force agency distribution channel showed a modest Reserves (1,429) 5,010

growth and is expected to incrementally contribute to future profits. Retained earnings 70,001 57,209

Total Equity 93,500 87,147

Investments

Guardian Group Fatum Life’s higher income from investing activities of AWG 3.3 Million was

mostly a result of the following factors. Liabilities

• Interest income from the held to maturity portfolio (local government bonds and deposits) Insurance contracts 761,607 710,320

increased by AWG 2.4 Million. We capitalized on increasing rates on time deposits to Due to affiliates 56 19,037

maximize returns on any excess cash. Profit tax payable 1,533 1,580

• Net realized and unrealized gains (and losses) increased by AWG 1.2 Million (mostly due to Other liabilities 12,811 11,948

fair value gains). Total Liabilities 776,007 742,885

• Other income (combined) decreased by AWG 0.3 Million.

Operating expenses Total equity and liabilities 869,507 830,032

The Company’s operating expenses increased slightly by AWG 0.1 Million (1%) to AWG 14.0

Million in 2021 from AWG 13.9 Million in 2020. This is an excellent feature of our performance. Abbreviated Statement of Income

We continued with a project to realize optimal efficiencies via digitizing and implementing For the year ended December 31, 2021 (In AWG’000)

robotics in our departments. We continue to seek inorganic growth opportunities while focusing 2021 2020

on rigorous cost control ; this remains a key performance objective. Net result from insurance activities (14,007) (15,283)

Net results Net income from investing activities 40,869 37,600

The net profit for the year 2021 was AWG 12.7 Million, as compared to AWG 5.9 Million in Net income from all activities 26,862 22,317

2020. The key technical ratios of all lines of business remained satisfactory despite the difficult

circumstances. The solvency position continued to be strong and well in excess of the local Net impairment gains/(losses) on financial assets (295) (1,030)

requirements of the Central Bank of Aruba and remains a solid base for future growth of our Operating expenses (13,951) (13,867)

company. Finance charges (734) (608)

Change in accounting policy Operating profit 11,882 6,812

One of the most defining events for the global insurance industry is undoubtedly the issuance Share of profit of associated companies 2,444 637

of the new insurance accounting standard, IFRS 17, after a two-decade long journey em- Profit before taxation 14,326 7,449

barked upon by the International Accounting Standard Board (IASB). It is the first comprehen- Taxation (1,534) (1,580)

sive international accounting standard for insurance contracts. Our Group has already started Profit for the year 12,792 5,869

preparing for the implementation of IFRS 17 to ensure timely and complete compliance with

this new standard which is effective from January 1, 2023.

Solvency requirements (In AWG’000) 2021 2020

Strategic initiatives

In 2021 we continued working on the implementation of a new strategic plan designed to Minimum regulatory capital 56,506 52,964

create an organization geared towards retaining and growing our customer base through an Regulatory capital held 93,500 87,147

enhanced customer experience. We are happy to report that many positive impacts of our Surplus 36,994 34,183

plan are starting to become evident and have significantly contributed to our results.

We will continue to deploy our plan which includes increased levels of automation,

straight-through-processing, customer self-service and data-analytics.

respects, with the audited financial statements of the Company, as described in note 2 “Basis

Moving forward, with confidence of preparation”.

In 2021 we continued to work on a variety of initiatives to make our companies ready for the

future challenges. The effects are already becoming visible. The Abbreviated Financial Statements

The geopolitical situation in Eastern Europe intensified in February 2022, with Russia’s invasion The abbreviated financial statements do not contain all the disclosures required by International

Financial Reporting Standards. Reading the abbreviated financial statements and the auditor’s

of Ukraine. Guardian Group Fatum does not have direct exposure to Ukraine, Russia, or Belarus, report thereon, therefore, is not a substitute for reading the audited financial statements and

nor do we expect to have material indirect exposures regarding the sanctions imposed. the auditor’s report thereon. The audited financial statements, and the abbreviated financial

In closing, we would like to thank our shareholders and customers for their loyalty to Guardian statements do not reflect the effects of events that occurred subsequent to the date of our

Group, as well as our staff for their energy and commitment in pursuing our vision of becoming report on the audited financial statements.

a world-class insurer.

The Audited Financial Statements and Our Report Thereon

Jacques van der Scheer We expressed an unmodified audit opinion on the audited financial statements in our report

Managing Director dated June 29, 2022.

The Board of Directors’ Responsibility for the Abbreviated Financial Statements

Independent auditor’s report The Board of Directors is responsible for the preparation of the abbreviated financial statements

in accordance with the basis as described in note 2 “Basis of preparation”.

Our Opinion Auditor’s Responsibility

The abbreviated financial statements, which comprise the abbreviated statement of financial Our responsibility is to express an opinion on whether the abbreviated financial statements

position as at December 31, 2021, the abbreviated statement of comprehensive income for are consistent, in all material respects, with the audited financial statements based on our

the year ended December 31, 2021 and notes to the abbreviated financial statements, are procedures, which were conducted in accordance with International Standard on Auditing

derived from the audited financial statements of Fatum Life Aruba N.V. (‘the Company’) for 810, Engagements to Report on Summary Financial Statements.

the year ended December 31, 2021. 18

Aruba, June 29, 2022

In our opinion, the accompanying abbreviated financial statements are consistent, in all material Grant Thornton Aruba Original signed by Edsel N. Lopez