Page 10 - AHATA

P. 10

AWEMainta.com DIARAZON 14 JULI 2021| 7

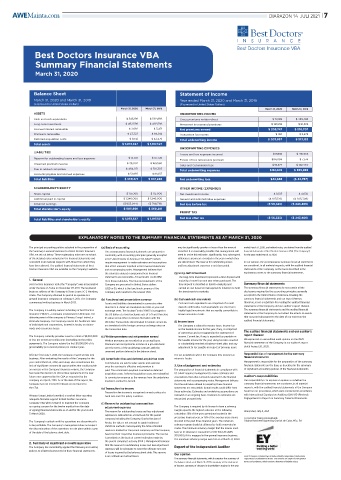

Best Doctors Insurance VBA

Best Doctors Insurance VBA

Summary Financial Statements

March 31, 2020

Balance Sheet Statement of Income

March 31, 2020 and March 31, 2019 Year ended March 31, 2020 and March 31, 2019

(Expressed in United States Dollars) (Expressed in United States Dollars)

March 31, 2020 March 31, 2019 March 31, 2020 March 31, 2019

ASSETS UNDERWRITING INCOME

Cash and cash equivalents $ 545,198 $ 592,968 Gross premiums written-direct $ 72,189 $ 429,482

Long-tenn investment $ 492,598 $ 492,598 Movement in unearned premiums $ 131,558 $ 81,225

Accrued interest receivable $ 2,692 $ 3,471 Net premiums earned $ 203,747 $ 510,707

Premiums receivable $ 23,327 $ 66,014 Transaction fee income $ 150 $ 2,475

Deferred acquisition costs $ 9,512 $ 42,476 Total underwriting income $ 203,897 $ 513,182

Total assets $ 1,073,327 $ 1,197,527

UNDERWRITING EXPENSES

LIABILITIES

Losses and loss expenses incurred $17,838 $ 415,955

Reserve for outstanding losses and loss expenses $ 15,301 $ 67,726 $94,094 $ 7,574

Excess of loss reinsurance premium

Unearned premium reserve $ 38,002 $ 169,560 Sales and Commission fees $49,277 $ 132,440

Due to related companies $ 464,071 $ 318,303 Total underwriting expenses $161,209 $ 555,969

Accounts payable and accrued expenses $ 51,997 $ 81,657

Total liabilities $ 569,371 $ 637,246 Net underwriting loss $42,688 ($ 42,787)

SHAREHOLDER'S EQUITY OTHER INCOME (EXPENSES)

Share capital $ 113,000 $ 113,000 Net investment income $ 8,515 $ 4,630

Additional paid in capital $ 1,246,000 $ 1,246,000 General and administrative expenses ($ 107,528) ($ 205,309)

Retained earnings ($ 855,044) ($ 798,719) Net loss before tax ($ 56,325) ($ 243,466)

Total shareholder’s equity $ 503,956 $ 560,281

PROFIT TAX

Total liabilities and shareholder’s equity $ 1,073,327 $ 1,197,527 Net loss after tax ($ 56,325) ($ 243,466)

EXPLANATORY NOTES TO THE SUMMARY FINANCIAL STATEMENTS AS AT MARCH 31, 2020

The principal accounting policies adopted in the preparation of (a) Basis of accounting may be significantly greater or lesser than the amount ended March 31, 2020, and related notes, are derived from the audited

the Summary Financial Statements of Best Doctors Insurance The accompanying financial statements are prepared in recorded. It is reasonably possible that management will financial statements of Best Doctors Insurance VBA (“the Company”)

VBA are set out below. These explanatory notes are an extract conformity with accounting principles generally accepted need to revise this estimate significantly. Any subsequent for the year ended March 31, 2020.

of the detailed notes included in the financial statements and in the United States of America (“US GAAP”) which differences arising are recorded in the year in which they

consistent in all material respects with those from which they require management to make estimates and assumptions are determined. The reserve for outstanding losses In our opinion, the accompanying summary financial statements

have been derived. The audited financial statements of Best that affect amounts reported in the financial statements and loss adjustment expenses is not discounted. are consistent, in all material respects, with the audited financial

Doctors Insurance VBA are available on the Company’s website. and accompanying notes. Management believes that statements of the Company, on the basis described in the

the estimates utilized in preparing these financial (g) Long-term investment explanatory notes to the summary financial statements.

statements are reasonable. Actual results could differ The long-term investment represents a time deposit with

1. General from those estimates. The financial statements of the maturity of more than one year when purchased. The

Best Doctors Insurance VBA (the “Company”) was incorporated Company are presented in United States dollars time deposit is classified as held-to-maturity and Summary financial statements

under the laws of Aruba on November 29, 2011. The registered (USD or $), which is the functional currency of the carried at cost based on management’s intention to hold The summary financial statements do not contain all the

business address of the Company is Seroe Lopes 5C-1, Paradera, Company and rounded to the nearest USD. the investments to maturity. disclosures required by the accounting principles generally

Aruba. The Company obtained its permit to operate as a accepted in the United States of America. Reading the

general insurance company on February 1, 2013. The Company (b) Functional and presentation currency (h) Cash and cash equivalents summary financial statements and our report thereon,

commenced writing business in March 2013. Assets and liabilities denominated in currencies other Cash and cash equivalents are comprised of current therefore, is not a substitute for reading the audited financial

than the U.S. dollar are translated into USD at year-end deposits with banks. Cash equivalents are short-term statements of the Company and our auditor’s report thereon.

The Company is a wholly-owned subsidiary of Best Doctors exchange rates. The Aruban Florin (“AWG”) is pegged to highly liquid investments that are readily convertible to The summary financial statements and the audited financial

Insurance (“BDIL”), a company incorporated in Bermuda. The the US dollar at a fixed exchange rate of 1.79 and therefore known amounts of cash. statements of the Company do not reflect the effects of events

ultimate parent of the company is Primary Group Limited, a its value versus other currencies fluctuates with the that occurred subsequent to the date of our report on the

Bermuda Company. The Company insures the healthcare risks US dollar. Transactions denominated in foreign currencies (i) Income taxes audited financial statements.

of individuals and corporations, located in Aruba, on claims- are translated at the foreign currency exchange rates on The Company is subject to income taxes. Income tax

made and occurrence bases. the transaction date. on the taxable income for the year, if any, is comprised

of current tax and is recognized in the statement of The audited financial statements and our auditor’s

The Company currently provides cover to a limit of $5,000,000 (c) Written premiums and net premium earned income. Current tax, if any, is expected tax payable on report thereon

or less per person per policy year depending on the policy Written premiums are recorded on an accrual basis. the taxable income for the year, using tax rates enacted We expressed an unmodified audit opinion on the 2020

agreements. The Company retains the first $1,000,000 of its Premiums are recognized as income on a pro-rata basis or substantially enacted at balance sheet date, and any financial statements of the Company in our auditor’s report

gross liability per covered person per contract year. over the terms of the underlying contracts with the adjustment to tax payable in respect of previous years. dated August 20, 2020.

unearned portion deferred in the balance sheet.

Effective from July 1, 2018, the Company ceased writing new The tax jurisdiction where the Company files income tax Responsibilities of management for the summary

business. After evaluating the results of the Company for the (d) Commission fees and deferred acquisition costs returns is Aruba. financial statements

year ended March 31, 2018, and taking into consideration the Commissions are paid to sales agents and agencies Management is responsible for the preparation of the summary

lack of significant commercial opportunities that could provide once the contract is effective and premium is 3. Use of judgement and estimates financial statements on the basis as described in the summary

an increase in the Company’s business volume, the Company paid. The commission payment is entered as deferred The preparation of financial statements in compliance with of significant accounting policies of the financial statements.

has made the decision to discontinue operations in the near acquisition costs. Deferred acquisition costs are reclassified US GAAP requires management to make estimates and

future once approved by the CBA as requested by the to commission expense as the revenue from the underlying assumptions that affect amounts reported in the financial Auditor’s responsibilities

company on April 5, 2019. As of the date of this report, the insurance contract is earned. statements and accompanying notes. Management believes Our responsibility is to express an opinion on whether the

Company has not received feedback on its request to that the estimates utilized in preparing these financial summary financial statements are consistent, in all material

the CBA. (e) Transaction fee income statements are reasonable. Actual results could differ from respects, with the audited financial statements of the Company

Transaction fee income is recognized on each policy at a those estimates. Estimates and underlying assumptions are based on our procedures, which were conducted in accordance

Primary Group Limited provided a comfort letter asserting fixed rate once the policy is written. reviewed on an ongoing basis. Revisions to estimates are with International Standard on Auditing (ISA) 810 (Revised),

adequate financial support to Best Doctors Insurance recognized prospectively. Engagements to Report on Summary Financial Statements.

Company VBA when required to maintain the Company (f) Reserve for outstanding losses and loss

as a going concern for the twelve months from the date adjustment expenses The Company is required by its license to have a solvency

of signing financial statements as of and for the year ended The reserve for outstanding losses and loss adjustment margin equal to the highest outcome of the following Oranjestad, July 8, 2021

31 March 2020. calculation: 15% of the gross premiums booked in the

expenses is estimated on a total basis for the parent

company including the Company. Due to the size of preceding financial year, or 15% of the average gross claims For Ernst & Young Accountants

The Company’s outlook until the operations are discontinued is Aruba, the data is not enough to apply traditional incurred in the past three financial years. The minimum Original has been signed by Garrick de Cuba, MSc, RA

to be profitable. The Company’s management does not expect statistical methods. Subsequently the total estimated solvency margin should at all times be held or invested in

the discontinuation of the operations to take place within a year reserve is divided for the parent company and the Company Aruba. The minimum solvency margin that the insurer must

of the date of the balance sheet date. have at its disposal is equivalent to USD 168,539 (AWG

based on their respective insurance premiums. The reserve 300,000) if it is engaged in the general insurance business.

is provided on the basis of current estimates made by The minimum solvency margin was met as at March 31, 2020.

the parent company’s actuary (BDIL). Management believes

2. Summary of significant accounting policies that the reserve for outstanding losses and loss adjustment

The Company has consistently applied the following accounting expenses will be adequate to cover the ultimate net cost Report of the Independent Auditor

policies to all periods presented in these financial statements.

of losses incurred to the balance sheet date. This reserve

is an estimate and actual losses Our opinion Ernst & Young is a partnership of limited liability companies (‘professional

The summary financial statements, which comprise the summary of corporations’) established in Aruba. Our services are subject to the general

the balance sheet as of March 31, 2020, summary of the statement terms and conditions, which contain a limitation of liability clause.

of income, summary of changes in shareholder’s equity for the year