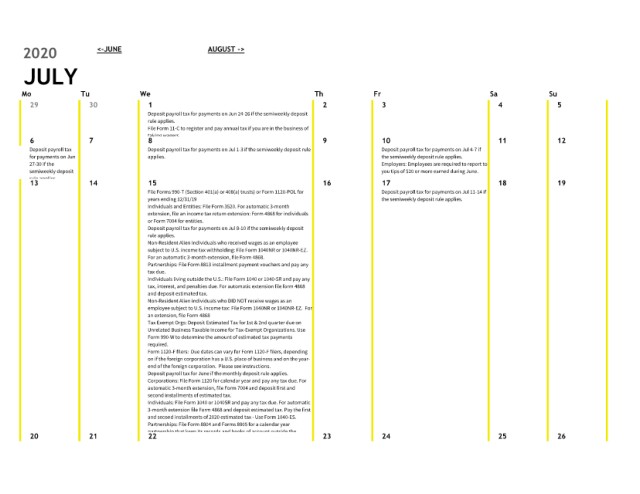

Page 13 - Payroll Taxes Calendar

P. 13

2020 <-JUNE AUGUST ->

JULY

Mo Tu We Th Fr Sa Su

29 30 1 2 3 4 5

Deposit payroll tax for payments on Jun 24-26 if the semiweekly deposit

rule applies.

File Form 11-C to register and pay annual tax if you are in the business of

taking wagers

6 7 8 9 10 11 12

Deposit payroll tax Deposit payroll tax for payments on Jul 1-3 if the semiweekly deposit rule Deposit payroll tax for payments on Jul 4-7 if

for payments on Jun applies. the semiweekly deposit rule applies.

27-30 if the Employers: Employees are required to report to

semiweekly deposit you tips of $20 or more earned during June.

rule applies

13 14 15 16 17 18 19

File Forms 990-T (Section 401(a) or 408(a) trusts) or Form 1120-POL for Deposit payroll tax for payments on Jul 11-14 if

years ending 12/31/19 the semiweekly deposit rule applies.

Individuals and Entities: File Form 3520. For automatic 3-month

extension, file an income tax return extension: Form 4868 for individuals

or Form 7004 for entities.

Deposit payroll tax for payments on Jul 8-10 if the semiweekly deposit

rule applies.

Non-Resident Alien Individuals who received wages as an employee

subject to U.S. income tax withholding: File Form 1040NR or 1040NR-EZ.

For an automatic 3-month extension, file Form 4868.

Partnerships: File Form 8813 installment payment vouchers and pay any

tax due.

Individuals living outside the U.S.: File Form 1040 or 1040-SR and pay any

tax, interest, and penalties due. For automatic extension file form 4868

and deposit estimated tax.

Non-Resident Alien individuals who DID NOT receive wages as an

employee subject to U.S. income tax: File Form 1040NR or 1040NR-EZ. For

an extension, file Form 4868

Tax Exempt Orgs: Deposit Estimated Tax for 1st & 2nd quarter due on

Unrelated Business Taxable Income for Tax-Exempt Organizations. Use

Form 990-W to determine the amount of estimated tax payments

required.

Form 1120-F filers: Due dates can vary for Form 1120-F filers, depending

on if the foreign corporation has a U.S. place of business and on the year-

end of the foreign corporation. Please see instructions.

Deposit payroll tax for June if the monthly deposit rule applies.

Corporations: File Form 1120 for calendar year and pay any tax due. For

automatic 3-month extension, file Form 7004 and deposit first and

second installments of estimated tax.

Individuals: File Form 1040 or 1040SR and pay any tax due. For automatic

3-month extension file Form 4868 and deposit estimated tax. Pay the first

and second installments of 2020 estimated tax - Use Form 1040-ES.

Partnerships: File Form 8804 and Forms 8805 for a calendar year

partnership that keep its records and books of account outside the

20 21 22 23 24 25 26