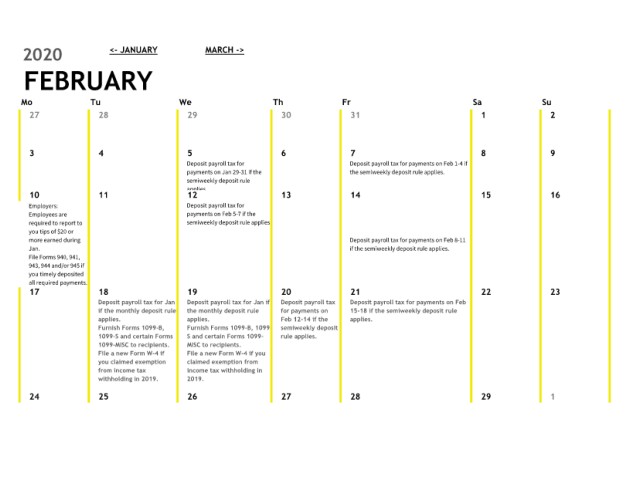

Page 4 - Payroll Taxes Calendar

P. 4

2020 <- JANUARY MARCH ->

FEBRUARY

Mo Tu We Th Fr Sa Su

27 28 29 30 31 1 2

3 4 5 6 7 8 9

Deposit payroll tax for Deposit payroll tax for payments on Feb 1-4 if

payments on Jan 29-31 if the the semiweekly deposit rule applies.

semiweekly deposit rule

applies

10 11 12 13 14 15 16

Employers: Deposit payroll tax for

Employees are payments on Feb 5-7 if the

required to report to semiweekly deposit rule applies

you tips of $20 or

more earned during Deposit payroll tax for payments on Feb 8-11

Jan. if the semiweekly deposit rule applies.

File Forms 940, 941,

943, 944 and/or 945 if

you timely deposited

all required payments.

17 18 19 20 21 22 23

Deposit payroll tax for Jan Deposit payroll tax for Jan if Deposit payroll tax Deposit payroll tax for payments on Feb

if the monthly deposit rule the monthly deposit rule for payments on 15-18 if the semiweekly deposit rule

applies. applies. Feb 12-14 if the applies.

Furnish Forms 1099-B, Furnish Forms 1099-B, 1099- semiweekly deposit

1099-S and certain Forms S and certain Forms 1099- rule applies.

1099-MISC to recipients. MISC to recipients.

File a new Form W-4 if File a new Form W-4 if you

you claimed exemption claimed exemption from

from income tax income tax withholding in

withholding in 2019. 2019.

24 25 26 27 28 29 1