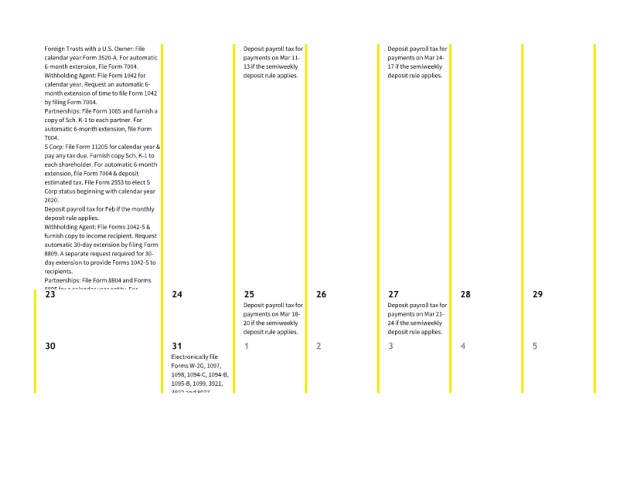

Page 7 - Payroll Taxes Calendar

P. 7

Foreign Trusts with a U.S. Owner: File Deposit payroll tax for Deposit payroll tax for

calendar year Form 3520-A. For automatic payments on Mar 11- payments on Mar 14-

6-month extension, file Form 7004. 13 if the semiweekly 17 if the semiweekly

Withholding Agent: File Form 1042 for deposit rule applies. deposit rule applies.

calendar year. Request an automatic 6-

month extension of time to file Form 1042

by filing Form 7004.

Partnerships: File Form 1065 and furnish a

copy of Sch. K-1 to each partner. For

automatic 6-month extension, file Form

7004.

S Corp: File Form 1120S for calendar year &

pay any tax due. Furnish copy Sch. K-1 to

each shareholder. For automatic 6-month

extension, file Form 7004 & deposit

estimated tax. File Form 2553 to elect S

Corp status beginning with calendar year

2020.

Deposit payroll tax for Feb if the monthly

deposit rule applies.

Withholding Agent: File Forms 1042-S &

furnish copy to income recipient. Request

automatic 30-day extension by filing Form

8809. A separate request required for 30-

day extension to provide Forms 1042-S to

recipients.

Partnerships: File Form 8804 and Forms

8805 for a calendar year entity For

23 24 25 26 27 28 29

Deposit payroll tax for Deposit payroll tax for

payments on Mar 18- payments on Mar 21-

20 if the semiweekly 24 if the semiweekly

deposit rule applies. deposit rule applies.

30 31 1 2 3 4 5

Electronically file

Forms W-2G, 1097,

1098, 1094-C, 1094-B,

1095-B, 1099, 3921,

3922 and 8027