Page 15 - Internal Auditing Standards

P. 15

2. Clarifi ed ISAs

In March 2009, the IAASB announced the completion of its program to enhance the clarity of its ISAs (Clarity

Project). This program involved the application of new drafting conventions to all ISAs, either as part of a

substantive revision or through a limited redrafting, to reflect the new conventions and matters of clarity

generally. Auditors now have access to 36 newly updated and clarified ISAs and a clarifi ed ISQC.

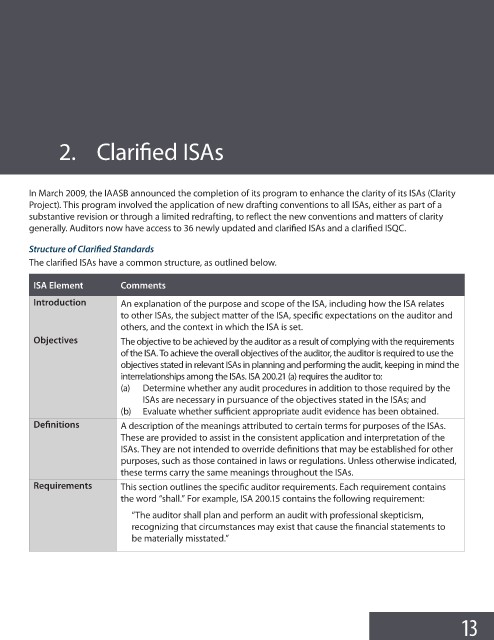

Structure of Clarifi ed Standards

The clarified ISAs have a common structure, as outlined below.

ISA Element Comments

Introduction An explanation of the purpose and scope of the ISA, including how the ISA relates

to other ISAs, the subject matter of the ISA, specific expectations on the auditor and

others, and the context in which the ISA is set.

Objectives The objective to be achieved by the auditor as a result of complying with the requirements

of the ISA. To achieve the overall objectives of the auditor, the auditor is required to use the

objectives stated in relevant ISAs in planning and performing the audit, keeping in mind the

interrelationships among the ISAs. ISA 200.21 (a) requires the auditor to:

(a) Determine whether any audit procedures in addition to those required by the

ISAs are necessary in pursuance of the objectives stated in the ISAs; and

(b) Evaluate whether sufficient appropriate audit evidence has been obtained.

Defi nitions A description of the meanings attributed to certain terms for purposes of the ISAs.

These are provided to assist in the consistent application and interpretation of the

ISAs. They are not intended to override definitions that may be established for other

purposes, such as those contained in laws or regulations. Unless otherwise indicated,

these terms carry the same meanings throughout the ISAs.

Requirements This section outlines the specific auditor requirements. Each requirement contains

the word “shall.” For example, ISA 200.15 contains the following requirement:

“The auditor shall plan and perform an audit with professional skepticism,

recognizing that circumstances may exist that cause the financial statements to

be materially misstated.”

13