Page 17 - Internal Auditing Standards

P. 17

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

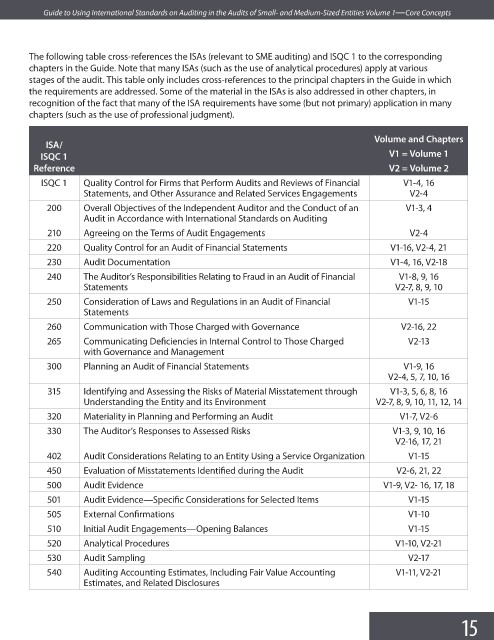

The following table cross-references the ISAs (relevant to SME auditing) and ISQC 1 to the corresponding

chapters in the Guide. Note that many ISAs (such as the use of analytical procedures) apply at various

stages of the audit. This table only includes cross-references to the principal chapters in the Guide in which

the requirements are addressed. Some of the material in the ISAs is also addressed in other chapters, in

recognition of the fact that many of the ISA requirements have some (but not primary) application in many

chapters (such as the use of professional judgment).

Volume and Chapters

ISA/

ISQC 1 V1 = Volume 1

Reference V2 = Volume 2

ISQC 1 Quality Control for Firms that Perform Audits and Reviews of Financial V1-4, 16

Statements, and Other Assurance and Related Services Engagements V2-4

200 Overall Objectives of the Independent Auditor and the Conduct of an V1-3, 4

Audit in Accordance with International Standards on Auditing

210 Agreeing on the Terms of Audit Engagements V2-4

220 Quality Control for an Audit of Financial Statements V1-16, V2-4, 21

230 Audit Documentation V1-4, 16, V2-18

240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial V1-8, 9, 16

Statements V2-7, 8, 9, 10

250 Consideration of Laws and Regulations in an Audit of Financial V1-15

Statements

260 Communication with Those Charged with Governance V2-16, 22

265 Communicating Deficiencies in Internal Control to Those Charged V2-13

with Governance and Management

300 Planning an Audit of Financial Statements V1-9, 16

V2-4, 5, 7, 10, 16

315 Identifying and Assessing the Risks of Material Misstatement through V1-3, 5, 6, 8, 16

Understanding the Entity and its Environment V2-7, 8, 9, 10, 11, 12, 14

320 Materiality in Planning and Performing an Audit V1-7, V2-6

330 The Auditor’s Responses to Assessed Risks V1-3, 9, 10, 16

V2-16, 17, 21

402 Audit Considerations Relating to an Entity Using a Service Organization V1-15

450 Evaluation of Misstatements Identified during the Audit V2-6, 21, 22

500 Audit Evidence V1-9, V2- 16, 17, 18

501 Audit Evidence—Specific Considerations for Selected Items V1-15

505 External Confi rmations V1-10

510 Initial Audit Engagements—Opening Balances V1-15

520 Analytical Procedures V1-10, V2-21

530 Audit Sampling V2-17

540 Auditing Accounting Estimates, Including Fair Value Accounting V1-11, V2-21

Estimates, and Related Disclosures

15