Page 160 - Internal Auditing Standards

P. 160

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

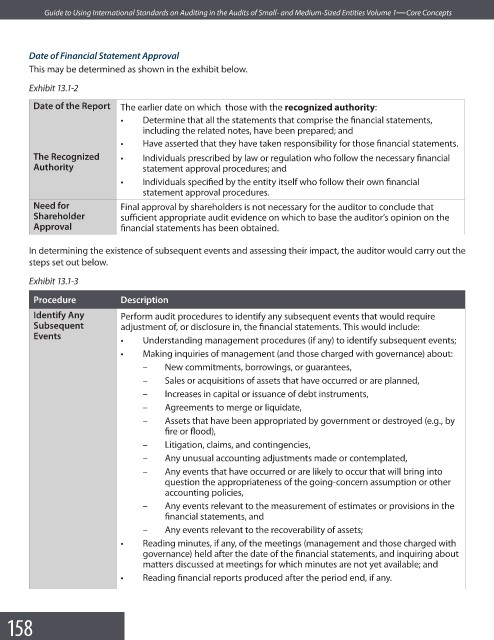

Date of Financial Statement Approval

This may be determined as shown in the exhibit below.

Exhibit 13.1-2

Date of the Report The earlier date on which those with the recognized authority:

• Determine that all the statements that comprise the fi nancial statements,

including the related notes, have been prepared; and

• Have asserted that they have taken responsibility for those fi nancial statements.

The Recognized • Individuals prescribed by law or regulation who follow the necessary fi nancial

Authority statement approval procedures; and

• Individuals specified by the entity itself who follow their own fi nancial

statement approval procedures.

Need for Final approval by shareholders is not necessary for the auditor to conclude that

Shareholder sufficient appropriate audit evidence on which to base the auditor’s opinion on the

Approval financial statements has been obtained.

In determining the existence of subsequent events and assessing their impact, the auditor would carry out the

steps set out below.

Exhibit 13.1-3

Procedure Description

Identify Any Perform audit procedures to identify any subsequent events that would require

Subsequent adjustment of, or disclosure in, the financial statements. This would include:

Events

• Understanding management procedures (if any) to identify subsequent events;

• Making inquiries of management (and those charged with governance) about:

– New commitments, borrowings, or guarantees,

– Sales or acquisitions of assets that have occurred or are planned,

– Increases in capital or issuance of debt instruments,

– Agreements to merge or liquidate,

– Assets that have been appropriated by government or destroyed (e.g., by

fire or fl ood),

– Litigation, claims, and contingencies,

– Any unusual accounting adjustments made or contemplated,

– Any events that have occurred or are likely to occur that will bring into

question the appropriateness of the going-concern assumption or other

accounting policies,

– Any events relevant to the measurement of estimates or provisions in the

financial statements, and

– Any events relevant to the recoverability of assets;

• Reading minutes, if any, of the meetings (management and those charged with

governance) held after the date of the financial statements, and inquiring about

matters discussed at meetings for which minutes are not yet available; and

• Reading financial reports produced after the period end, if any.

158