Page 237 - Internal Auditing Standards

P. 237

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

17.6 Supplementary Information Presented with the Financial Statements

Supplementary information is information presented with the audited financial statements, but not required

by the applicable financial reporting framework. Supplementary information may be required by law,

regulation, or standards, or may be presented voluntarily.

Supplementary information (not required by the applicable financial reporting framework) needs to be

clearly differentiated from the audited financial statements unless it is an integral part of the audited fi nancial

statements. If such supplementary information is not clearly differentiated, the auditor shall ask management

to change how the unaudited supplementary information is presented. If management refuses to do so, the

auditor shall explain in the auditor’s report that such supplementary information has not been audited.

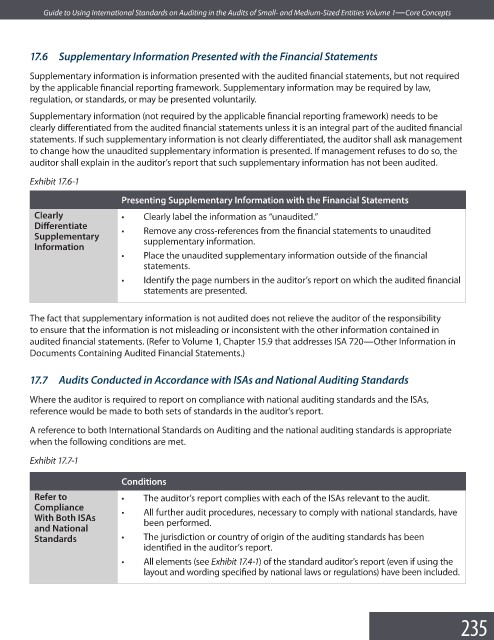

Exhibit 17.6-1

Presenting Supplementary Information with the Financial Statements

Clearly • Clearly label the information as “unaudited.”

Diff erentiate • Remove any cross-references from the financial statements to unaudited

Supplementary supplementary information.

Information

• Place the unaudited supplementary information outside of the fi nancial

statements.

• Identify the page numbers in the auditor’s report on which the audited fi nancial

statements are presented.

The fact that supplementary information is not audited does not relieve the auditor of the responsibility

to ensure that the information is not misleading or inconsistent with the other information contained in

audited financial statements. (Refer to Volume 1, Chapter 15.9 that addresses ISA 720—Other Information in

Documents Containing Audited Financial Statements.)

17.7 Audits Conducted in Accordance with ISAs and National Auditing Standards

Where the auditor is required to report on compliance with national auditing standards and the ISAs,

reference would be made to both sets of standards in the auditor’s report.

A reference to both International Standards on Auditing and the national auditing standards is appropriate

when the following conditions are met.

Exhibit 17.7-1

Conditions

Refer to • The auditor’s report complies with each of the ISAs relevant to the audit.

Compliance • All further audit procedures, necessary to comply with national standards, have

With Both ISAs been performed.

and National

Standards • The jurisdiction or country of origin of the auditing standards has been

identified in the auditor’s report.

• All elements (see Exhibit 17.4-1) of the standard auditor’s report (even if using the

layout and wording specified by national laws or regulations) have been included.

235