Page 232 - Internal Auditing Standards

P. 232

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

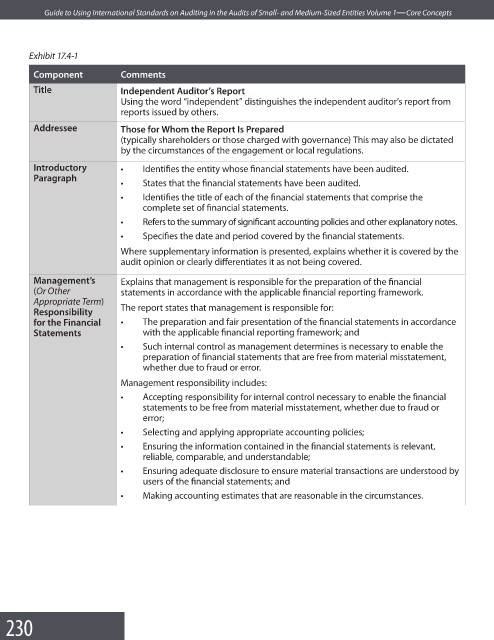

Exhibit 17.4-1

Component Comments

Title Independent Auditor’s Report

Using the word “independent” distinguishes the independent auditor’s report from

reports issued by others.

Addressee Those for Whom the Report Is Prepared

(typically shareholders or those charged with governance) This may also be dictated

by the circumstances of the engagement or local regulations.

Introductory • Identifies the entity whose financial statements have been audited.

Paragraph

• States that the financial statements have been audited.

• Identifies the title of each of the financial statements that comprise the

complete set of fi nancial statements.

• Refers to the summary of significant accounting policies and other explanatory notes.

• Specifies the date and period covered by the fi nancial statements.

Where supplementary information is presented, explains whether it is covered by the

audit opinion or clearly differentiates it as not being covered.

Management’s Explains that management is responsible for the preparation of the fi nancial

(Or Other statements in accordance with the applicable financial reporting framework.

Appropriate Term)

Responsibility The report states that management is responsible for:

for the Financial • The preparation and fair presentation of the financial statements in accordance

Statements with the applicable financial reporting framework; and

• Such internal control as management determines is necessary to enable the

preparation of financial statements that are free from material misstatement,

whether due to fraud or error.

Management responsibility includes:

• Accepting responsibility for internal control necessary to enable the fi nancial

statements to be free from material misstatement, whether due to fraud or

error;

• Selecting and applying appropriate accounting policies;

• Ensuring the information contained in the financial statements is relevant,

reliable, comparable, and understandable;

• Ensuring adequate disclosure to ensure material transactions are understood by

users of the financial statements; and

• Making accounting estimates that are reasonable in the circumstances.

230