Page 117 - Individual Forms & Instructions Guide

P. 117

Page 110 of 113 Fileid: … ions/i1040/2022/a/xml/cycle11/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

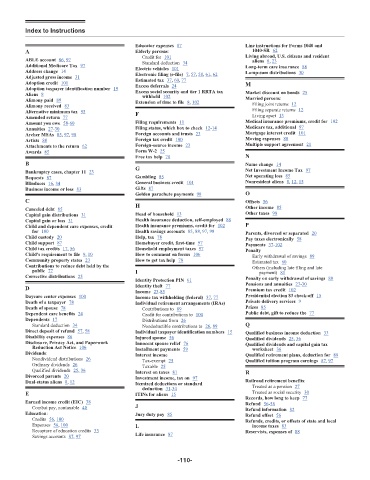

Index to Instructions 14:28 - 20-Jan-2023

Educator expenses 87 Line instructions for Forms 1040 and

A Elderly persons: 1040-SR 62

Credit for 101 Living abroad, U.S. citizens and resident

ABLE account 86, 97 Standard deduction 34 aliens 8, 23

Additional Medicare Tax 97 Long-term care insurance 88

Address change 14 Electric vehicles 101 Lump-sum distributions 30

Electronic filing (e-file) 7, 57, 58, 61, 62

Adjusted gross income 31

Adoption credit 101 Estimated tax 37, 60, 77 M

Excess deferrals 24

Adoption taxpayer identification number 19

Aliens 8 Excess social security and tier 1 RRTA tax Market discount on bonds 25

withheld 102

Alimony paid 89 Extension of time to file 8, 102 Married persons:

Alimony received 83 Filing joint returns 12

Alternative minimum tax 95 F Filing separate returns 12

Amended return 77 Living apart 13

Amount you owe 58-60 Filing requirements 11 Medical insurance premiums, credit for 102

Annuities 27-30 Filing status, which box to check 12-14 Medicare tax, additional 97

Archer MSAs 85, 97, 98 Foreign accounts and trusts 23 Mortgage interest credit 101

Artists 88 Foreign tax credit 100 Moving expenses 88

Attachments to the return 62 Foreign-source income 23 Multiple support agreement 21

Awards 85 Form W-2 25

Free tax help 78 N

B Name change 14

G

Bankruptcy cases, chapter 11 23 Net Investment Income Tax 97

Bequests 87 Gambling 85 Net operating loss 85

Blindness 16, 34 General business credit 101 Nonresident aliens 8, 12, 15

Business income or loss 83 Gifts 87

Golden parachute payments 98 O

C Offsets 56

H

Canceled debt 85 Other income 85

Capital gain distributions 31 Head of household 13 Other taxes 98

Capital gain or loss 31 Health insurance deduction, self-employed 88

Child and dependent care expenses, credit Health insurance premiums, credit for 102 P

for 100 Health savings accounts 85, 88, 97, 98 Parents, divorced or separated 20

Child custody 20 Help, tax 78 Pay taxes electronically 58

Child support 87 Homebuyer credit, first-time 97 Payments 37-102

Child tax credits 17, 56 Household employment taxes 97 Penalty

Child's requirement to file 9, 10 How to comment on forms 106 Early withdrawal of savings 89

Community property states 23 How to get tax help 78 Estimated tax 60

Contributions to reduce debt held by the Others (including late filing and late

public 77 I payment) 81

Corrective distributions 25 Penalty on early withdrawal of savings 89

Identity Protection PIN 61

D Identity theft 77 Pensions and annuities 27-30

Income 23-85 Premium tax credit 102

Daycare center expenses 100 Income tax withholding (federal) 37, 77 Presidential election $3 check-off 15

Death of a taxpayer 78 Individual retirement arrangements (IRAs) Private delivery services 9

Death of spouse 78 Contributions to 89 Prizes 85

Dependent care benefits 24 Credit for contributions to 100 Public debt, gift to reduce the 77

Dependents 17 Distributions from 26

Standard deduction 34 Nondeductible contributions to 26, 89 Q

Direct deposit of refund 57, 58 Individual taxpayer identification numbers 15 Qualified business income deduction 33

Disability expenses 86 Injured spouse 56 Qualified dividends 25, 36

Disclosure, Privacy Act, and Paperwork Innocent spouse relief 76 Qualified dividends and capital gain tax

Reduction Act Notice 106 Installment payments 59 worksheet 36

Dividends: Interest income Qualified retirement plans, deduction for 88

Nondividend distributions 26 Tax-exempt 25 Qualified tuition program earnings 87, 97

Ordinary dividends 26 Taxable 25

Qualified dividends 25, 36 Interest on taxes 81 R

Divorced parents 20 Investment income, tax on 97

Dual-status aliens 8, 12 Itemized deductions or standard Railroad retirement benefits:

deduction 31-34 Treated as a pension 27

E ITINs for aliens 15 Treated as social security 30

Records, how long to keep 77

Earned income credit (EIC) 38 Refund 56-58

Combat pay, nontaxable 40 J Refund information 82

Education: Jury duty pay 85 Refund offset 56

Credits 56, 100 Refunds, credits, or offsets of state and local

Expenses 56, 100 L income taxes 83

Recapture of education credits 33 Reservists, expenses of 88

Savings accounts 87, 97 Life insurance 87

-110-