Page 30 - Tax withholding and Estimated Taxes

P. 30

Page 28 of 47

Fileid: … tions/P505/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

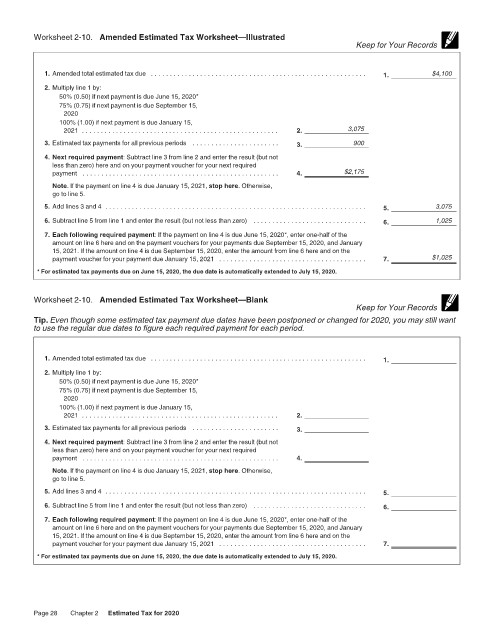

Worksheet 2-10. Amended Estimated Tax Worksheet—Illustrated 12:15 - 17-Jun-2020

Keep for Your Records

1. Amended total estimated tax due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $4,100

2. Multiply line 1 by:

50% (0.50) if next payment is due June 15, 2020*

75% (0.75) if next payment is due September 15,

2020

100% (1.00) if next payment is due January 15,

2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. 3,075

3. Estimated tax payments for all previous periods . . . . . . . . . . . . . . . . . . . . . . . 3. 900

4. Next required payment: Subtract line 3 from line 2 and enter the result (but not

less than zero) here and on your payment voucher for your next required

payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. $2,175

Note. If the payment on line 4 is due January 15, 2021, stop here. Otherwise,

go to line 5.

5. Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. 3,075

6. Subtract line 5 from line 1 and enter the result (but not less than zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. 1,025

7. Each following required payment: If the payment on line 4 is due June 15, 2020*, enter one-half of the

amount on line 6 here and on the payment vouchers for your payments due September 15, 2020, and January

15, 2021. If the amount on line 4 is due September 15, 2020, enter the amount from line 6 here and on the

payment voucher for your payment due January 15, 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. $1,025

* For estimated tax payments due on June 15, 2020, the due date is automatically extended to July 15, 2020.

Worksheet 2-10. Amended Estimated Tax Worksheet—Blank

Keep for Your Records

Tip. Even though some estimated tax payment due dates have been postponed or changed for 2020, you may still want

to use the regular due dates to figure each required payment for each period.

1. Amended total estimated tax due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Multiply line 1 by:

50% (0.50) if next payment is due June 15, 2020*

75% (0.75) if next payment is due September 15,

2020

100% (1.00) if next payment is due January 15,

2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Estimated tax payments for all previous periods . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Next required payment: Subtract line 3 from line 2 and enter the result (but not

less than zero) here and on your payment voucher for your next required

payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

Note. If the payment on line 4 is due January 15, 2021, stop here. Otherwise,

go to line 5.

5. Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. Subtract line 5 from line 1 and enter the result (but not less than zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Each following required payment: If the payment on line 4 is due June 15, 2020*, enter one-half of the

amount on line 6 here and on the payment vouchers for your payments due September 15, 2020, and January

15, 2021. If the amount on line 4 is due September 15, 2020, enter the amount from line 6 here and on the

payment voucher for your payment due January 15, 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

* For estimated tax payments due on June 15, 2020, the due date is automatically extended to July 15, 2020.

Page 28 Chapter 2 Estimated Tax for 2020