Page 28 - Tax withholding and Estimated Taxes

P. 28

12:15 - 17-Jun-2020

Page 26 of 47

Fileid: … tions/P505/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

b. Any tax on excess accumulations in even if you are due a refund when you file your When To Start

qualified retirement plans. income tax return.

3. The following write-ins on Schedule 2 If a payment is mailed, the date of the U.S. You don’t have to make estimated tax pay-

(Form 1040 or 1040-SR), line 8. postmark is considered the date of payment. ments until you have income on which you will

owe income tax. If you have income subject to

a. Excise tax on excess golden para- The general payment periods and due dates for estimated tax during the first payment period,

chute payments (identified as “EPP”). estimated tax payments are shown next. For you must make your first payment by the due

exceptions to the dates listed, see Saturday,

b. Excise tax on insider stock compen- Sunday, holiday rule. date for the first payment period.

sation from an expatriated corporation You have several options when paying esti-

(identified as “ISC”). For the period: Due date: mated taxes. You can:

c. Look-back interest due under section Jan. 1 – March 31 . . . . . . . . April 15 • Apply an overpayment from the previous

1

167(g) (identified as “From Form April 1 – May 31 . . . . . . . . . . June 15 tax year,

8866”). June 1 – Aug. 31 . . . . . . . . . Sept. 15 • Pay all your estimated tax by the due date

of your first payment, or

d. Look-back interest due under section Sept. 1 – Dec. 31 . . . . . . . . . Jan. 15, next year 2 • Pay it in installments.

460(b) (identified as “From Form 1 If your tax year does not

If you choose to pay in installments, make

8697”). begin on January 1, your first payment by the due date for the first

e. Recapture of federal mortgage sub- see Fiscal-year taxpayers payment period. Make your remaining install-

sidy (identified as “FMSR”). below. ment payments by the due dates for the later

2 See January payment below.

f. Uncollected social security and Medi- periods.

care tax or RRTA tax on tips or For estimated tax payments due on To avoid any estimated tax penalties, all in-

group-term life insurance (identified April 15, 2020, and June 15, 2020, the stallments must be paid by their due date and

!

as “UT”). CAUTION due date is automatically extended to for the required amount.

4. Any refundable credit amounts on Form July 15, 2020.

1040 or 1040-SR, line 18a, b, or c, and No income subject to estimated tax during

Schedule 3 (Form 1040 or 1040-SR), lines For more information, see Filing and Payment first period. If you don’t have income subject

9 and 12, and credit from Form 8885 inclu- Deadlines Questions and Answers on IRS.gov. to estimated tax until a later payment period,

ded on line 13. you must make your first payment by the due

Saturday, Sunday, holiday rule. If the due date for that period. You can pay your entire es-

Total Estimated Tax Payments date for an estimated tax payment falls on a timated tax by the due date for that period or

you can pay it in installments by the due date

Saturday, Sunday, or legal holiday, the pay-

Needed—Line 14a ment will be on time if you make it on the next for that period and the due dates for the remain-

day that isn’t a Saturday, Sunday, or a holiday. ing periods. Table 2-1 shows the general due

Use lines 13 and 14a to figure the total estima- See Pub. 509 for a list of all legal holidays. dates for making installment payments when

ted tax you may be required to pay for 2020. the due date does not fall on a Saturday, Sun-

Subtract your expected withholding from your January payment. If you file your 2020 Form day, or holiday.

required annual payment (line 12c). You must 1040 or 1040-SR by February 1, 2021, and pay

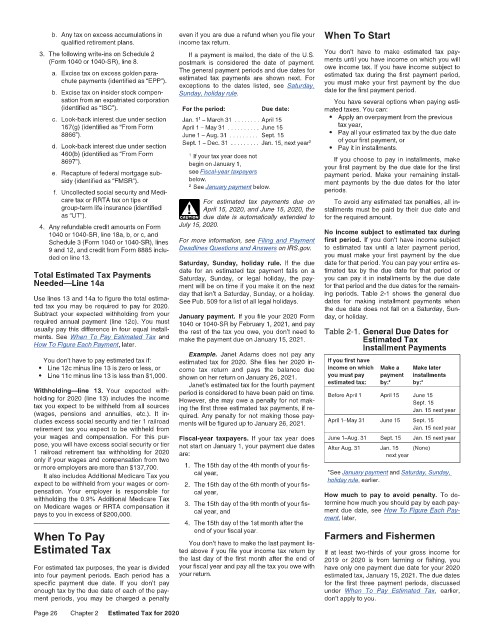

usually pay this difference in four equal install- the rest of the tax you owe, you don’t need to Table 2-1. General Due Dates for

ments. See When To Pay Estimated Tax and make the payment due on January 15, 2021. Estimated Tax

How To Figure Each Payment, later. Installment Payments

Example. Janet Adams does not pay any

You don’t have to pay estimated tax if: estimated tax for 2020. She files her 2020 in- If you first have

• Line 12c minus line 13 is zero or less, or come tax return and pays the balance due income on which Make a Make later

• Line 11c minus line 13 is less than $1,000. shown on her return on January 26, 2021. you must pay payment installments

Janet's estimated tax for the fourth payment estimated tax: by:* by:*

Withholding—line 13. Your expected with- period is considered to have been paid on time.

holding for 2020 (line 13) includes the income However, she may owe a penalty for not mak- Before April 1 April 15 June 15

tax you expect to be withheld from all sources ing the first three estimated tax payments, if re- Sept. 15

(wages, pensions and annuities, etc.). It in- quired. Any penalty for not making those pay- Jan. 15 next year

cludes excess social security and tier 1 railroad ments will be figured up to January 26, 2021. April 1–May 31 June 15 Sept. 15

retirement tax you expect to be withheld from Jan. 15 next year

your wages and compensation. For this pur- Fiscal-year taxpayers. If your tax year does June 1–Aug. 31 Sept. 15 Jan. 15 next year

pose, you will have excess social security or tier not start on January 1, your payment due dates After Aug. 31 Jan. 15 (None)

1 railroad retirement tax withholding for 2020 are: next year

only if your wages and compensation from two

or more employers are more than $137,700. 1. The 15th day of the 4th month of your fis-

It also includes Additional Medicare Tax you cal year, *See January payment and Saturday, Sunday,

expect to be withheld from your wages or com- 2. The 15th day of the 6th month of your fis- holiday rule, earlier.

pensation. Your employer is responsible for cal year, How much to pay to avoid penalty. To de-

withholding the 0.9% Additional Medicare Tax termine how much you should pay by each pay-

on Medicare wages or RRTA compensation it 3. The 15th day of the 9th month of your fis- ment due date, see How To Figure Each Pay-

pays to you in excess of $200,000. cal year, and ment, later.

4. The 15th day of the 1st month after the

When To Pay end of your fiscal year. Farmers and Fishermen

You don’t have to make the last payment lis-

Estimated Tax ted above if you file your income tax return by If at least two-thirds of your gross income for

the last day of the first month after the end of 2019 or 2020 is from farming or fishing, you

For estimated tax purposes, the year is divided your fiscal year and pay all the tax you owe with have only one payment due date for your 2020

into four payment periods. Each period has a your return. estimated tax, January 15, 2021. The due dates

specific payment due date. If you don’t pay for the first three payment periods, discussed

enough tax by the due date of each of the pay- under When To Pay Estimated Tax, earlier,

ment periods, you may be charged a penalty don’t apply to you.

Page 26 Chapter 2 Estimated Tax for 2020