Page 23 - Tax withholding and Estimated Taxes

P. 23

Page 21 of 47

Fileid: … tions/P505/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

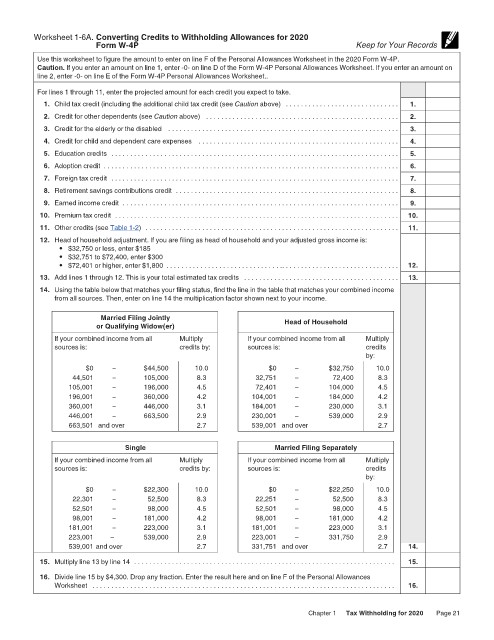

Worksheet 1-6A. Converting Credits to Withholding Allowances for 2020 12:15 - 17-Jun-2020

Form W-4P Keep for Your Records

Use this worksheet to figure the amount to enter on line F of the Personal Allowances Worksheet in the 2020 Form W-4P.

Caution. If you enter an amount on line 1, enter -0- on line D of the Form W-4P Personal Allowances Worksheet. If you enter an amount on

line 2, enter -0- on line E of the Form W-4P Personal Allowances Worksheet..

For lines 1 through 11, enter the projected amount for each credit you expect to take.

1. Child tax credit (including the additional child tax credit (see Caution above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Credit for other dependents (see Caution above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Credit for the elderly or the disabled . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Credit for child and dependent care expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Education credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. Adoption credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Foreign tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Retirement savings contributions credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Earned income credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Premium tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Other credits (see Table 1-2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Head of household adjustment. If you are filing as head of household and your adjusted gross income is:

• $32,750 or less, enter $185

• $32,751 to $72,400, enter $300

• $72,401 or higher, enter $1,800 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Add lines 1 through 12. This is your total estimated tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Using the table below that matches your filing status, find the line in the table that matches your combined income

from all sources. Then, enter on line 14 the multiplication factor shown next to your income.

Married Filing Jointly Head of Household

or Qualifying Widow(er)

If your combined income from all Multiply If your combined income from all Multiply

sources is: credits by: sources is: credits

by:

$0 – $44,500 10.0 $0 – $32,750 10.0

44,501 – 105,000 8.3 32,751 – 72,400 8.3

105,001 – 196,000 4.5 72,401 – 104,000 4.5

196,001 – 360,000 4.2 104,001 – 184,000 4.2

360,001 – 446,000 3.1 184,001 – 230,000 3.1

446,001 – 663,500 2.9 230,001 – 539,000 2.9

663,501 and over 2.7 539,001 and over 2.7

Single Married Filing Separately

If your combined income from all Multiply If your combined income from all Multiply

sources is: credits by: sources is: credits

by:

$0 – $22,300 10.0 $0 – $22,250 10.0

22,301 – 52,500 8.3 22,251 – 52,500 8.3

52,501 – 98,000 4.5 52,501 – 98,000 4.5

98,001 – 181,000 4.2 98,001 – 181,000 4.2

181,001 – 223,000 3.1 181,001 – 223,000 3.1

223,001 – 539,000 2.9 223,001 – 331,750 2.9

539,001 and over 2.7 331,751 and over 2.7 14.

15. Multiply line 13 by line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

16. Divide line 15 by $4,300. Drop any fraction. Enter the result here and on line F of the Personal Allowances

Worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

Chapter 1 Tax Withholding for 2020 Page 21