Page 27 - Tax withholding and Estimated Taxes

P. 27

12:15 - 17-Jun-2020

Page 25 of 47

Fileid: … tions/P505/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Tax on net capital gain. The regular in- (Schedule 2 (Form 1040 or 1040-SR), Required Annual Payment—

come tax rates for individuals don’t apply to a line 8). But don’t include recapture of a Line 12c

net capital gain. Instead, your net capital gain is federal mortgage subsidy; tax on excess

taxed at a lower maximum rate. golden parachute payments; look-back in- On lines 12a through 12c, figure the total

The term “net capital gain” means the terest due under section 167(g) or 460(b) amount you must pay for 2020, through with-

amount by which your net long-term capital gain of the Internal Revenue Code; excise tax holding and estimated tax payments, to avoid

for the year is more than your net short-term on insider stock compensation from an ex- paying a penalty.

capital loss. patriated corporation; or uncollected social

Tax on capital gain and qualified security and Medicare tax or RRTA tax on General rule. The total amount you must pay

is the smaller of:

tips or group-term life insurance.

dividends. If the amount on line 1 in-

cludes a net capital gain or qualified 4. Repayment of the first-time homebuyer 1. 90% of your total expected tax for 2020, or

dividends, use Worksheet 2-5 to figure your tax. credit. See Form 5405. 2. 100% of the total tax shown on your 2019

5. Additional Medicare Tax. A 0.9% Addi- return. Your 2019 tax return must cover all

Note. The tax rate on your capital gains and tional Medicare Tax applies to your com- 12 months.

dividends will depend on your income. bined Medicare wages and self-employ-

Tax if excluding foreign earned in- ment income and/or your RRTA Special rules. There are special rules for

come or excluding or deducting for- compensation that exceeds the amount higher income taxpayers and for farmers and

fishermen.

eign housing. If you expect to claim listed in the following chart, based on your

the foreign earned income exclusion or the filing status. Higher-income taxpayers. If your AGI for

housing exclusion or deduction on Form 2555, 2019 was more than $150,000 ($75,000 if your

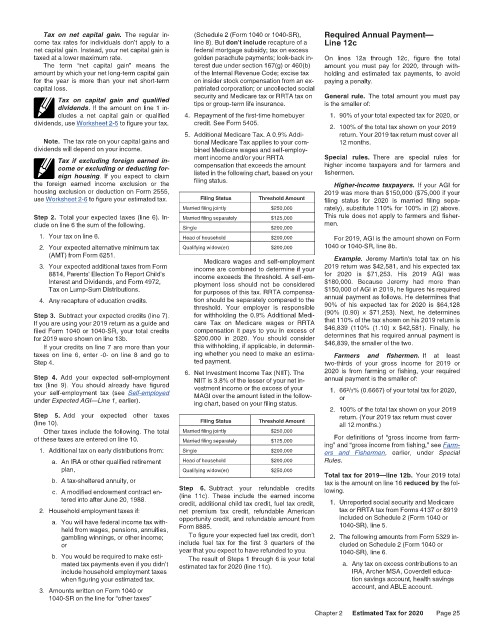

use Worksheet 2-6 to figure your estimated tax. Filing Status Threshold Amount filing status for 2020 is married filing sepa-

Married filing jointly $250,000 rately), substitute 110% for 100% in (2) above.

Step 2. Total your expected taxes (line 6). In- Married filing separately $125,000 This rule does not apply to farmers and fisher-

clude on line 6 the sum of the following. Single $200,000 men.

1. Your tax on line 6. Head of household $200,000 For 2019, AGI is the amount shown on Form

2. Your expected alternative minimum tax Qualifying widow(er) $200,000 1040 or 1040-SR, line 8b.

(AMT) from Form 6251. Example. Jeremy Martin's total tax on his

Medicare wages and self-employment

3. Your expected additional taxes from Form income are combined to determine if your 2019 return was $42,581, and his expected tax

8814, Parents' Election To Report Child's income exceeds the threshold. A self-em- for 2020 is $71,253. His 2019 AGI was

Interest and Dividends, and Form 4972, ployment loss should not be considered $180,000. Because Jeremy had more than

Tax on Lump-Sum Distributions. for purposes of this tax. RRTA compensa- $150,000 of AGI in 2019, he figures his required

4. Any recapture of education credits. tion should be separately compared to the annual payment as follows. He determines that

threshold. Your employer is responsible 90% of his expected tax for 2020 is $64,128

Step 3. Subtract your expected credits (line 7). for withholding the 0.9% Additional Medi- (90% (0.90) × $71,253). Next, he determines

If you are using your 2019 return as a guide and care Tax on Medicare wages or RRTA that 110% of the tax shown on his 2019 return is

filed Form 1040 or 1040-SR, your total credits compensation it pays to you in excess of $46,839 (110% (1.10) x $42,581). Finally, he

for 2019 were shown on line 13b. $200,000 in 2020. You should consider determines that his required annual payment is

$46,839, the smaller of the two.

If your credits on line 7 are more than your this withholding, if applicable, in determin-

taxes on line 6, enter -0- on line 8 and go to ing whether you need to make an estima- Farmers and fishermen. If at least

Step 4. ted payment. two-thirds of your gross income for 2019 or

6. Net Investment Income Tax (NIIT). The 2020 is from farming or fishing, your required

Step 4. Add your expected self-employment NIIT is 3.8% of the lesser of your net in- annual payment is the smaller of:

tax (line 9). You should already have figured vestment income or the excess of your

your self-employment tax (see Self-employed MAGI over the amount listed in the follow- 1. 66 2 /3% (0.6667) of your total tax for 2020,

under Expected AGI—Line 1, earlier). ing chart, based on your filing status. or

Step 5. Add your expected other taxes 2. 100% of the total tax shown on your 2019

return. (Your 2019 tax return must cover

(line 10). Filing Status Threshold Amount all 12 months.)

Other taxes include the following. The total Married filing jointly $250,000

For definitions of “gross income from farm-

of these taxes are entered on line 10. Married filing separately $125,000 ing” and “gross income from fishing,” see Farm-

1. Additional tax on early distributions from: Single $200,000 ers and Fishermen, earlier, under Special

a. An IRA or other qualified retirement Head of household $200,000 Rules.

plan, Qualifying widow(er) $250,000

b. A tax-sheltered annuity, or Total tax for 2019—line 12b. Your 2019 total

tax is the amount on line 16 reduced by the fol-

c. A modified endowment contract en- Step 6. Subtract your refundable credits lowing.

(line 11c). These include the earned income

tered into after June 20, 1988. credit, additional child tax credit, fuel tax credit, 1. Unreported social security and Medicare

2. Household employment taxes if: net premium tax credit, refundable American tax or RRTA tax from Forms 4137 or 8919

a. You will have federal income tax with- opportunity credit, and refundable amount from included on Schedule 2 (Form 1040 or

1040-SR), line 5.

held from wages, pensions, annuities, Form 8885.

gambling winnings, or other income; To figure your expected fuel tax credit, don’t 2. The following amounts from Form 5329 in-

or include fuel tax for the first 3 quarters of the cluded on Schedule 2 (Form 1040 or

b. You would be required to make esti- year that you expect to have refunded to you. 1040-SR), line 6.

The result of Steps 1 through 6 is your total

mated tax payments even if you didn’t estimated tax for 2020 (line 11c). a. Any tax on excess contributions to an

include household employment taxes IRA, Archer MSA, Coverdell educa-

when figuring your estimated tax. tion savings account, health savings

3. Amounts written on Form 1040 or account, and ABLE account.

1040-SR on the line for “other taxes”

Chapter 2 Estimated Tax for 2020 Page 25