Page 24 - Tax withholding and Estimated Taxes

P. 24

Page 22 of 47

Fileid: … tions/P505/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

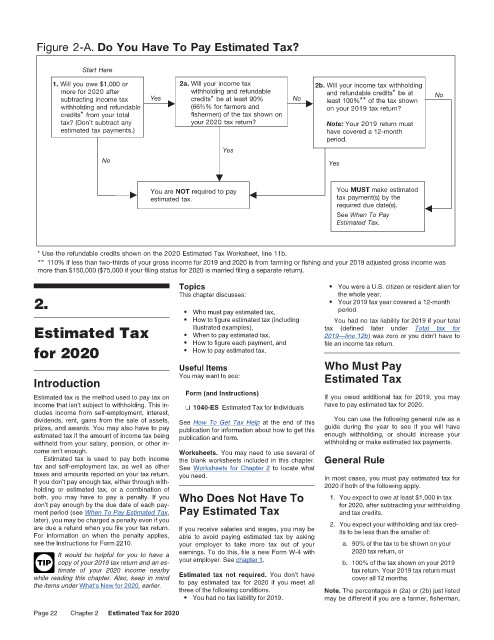

Figure 2-A. Do You Have To Pay Estimated Tax? 12:15 - 17-Jun-2020

Start Here

1. Will you owe $1,000 or 2a. Will your income tax 2b. Will your income tax withholding

more for 2020 after withholding and refundable and refundable credits* be at No

subtracting income tax Yes credits* be at least 90% No least 100%** of the tax shown

withholding and refundable (66 ⁄3% for farmers and on your 2019 tax return?

2

credits* from your total shermen) of the tax shown on

tax? (Don’t subtract any your 2020 tax return? Note: Your 2019 return must

estimated tax payments.) have covered a 12-month

period.

Yes

No Yes

You are NOT required to pay You MUST make estimated

estimated tax. tax payment(s) by the

required due date(s).

See When To Pay

Estimated Tax.

* Use the refundable credits shown on the 2020 Estimated Tax Worksheet, line 11b.

** 110% if less than two-thirds of your gross income for 2019 and 2020 is from farming or shing and your 2019 adjusted gross income was

more than $150,000 ($75,000 if your ling status for 2020 is married ling a separate return).

Topics • You were a U.S. citizen or resident alien for

This chapter discusses: the whole year.

2. • Your 2019 tax year covered a 12-month

• Who must pay estimated tax, period.

• How to figure estimated tax (including You had no tax liability for 2019 if your total

illustrated examples),

Estimated Tax • When to pay estimated tax, tax (defined later under Total tax for

2019—line 12b) was zero or you didn’t have to

• How to figure each payment, and file an income tax return.

for 2020 • How to pay estimated tax.

Useful Items Who Must Pay

Introduction You may want to see: Estimated Tax

Form (and Instructions)

Estimated tax is the method used to pay tax on If you owed additional tax for 2019, you may

income that isn’t subject to withholding. This in- 1040-ES 1040-ES Estimated Tax for Individuals have to pay estimated tax for 2020.

cludes income from self-employment, interest,

dividends, rent, gains from the sale of assets, See How To Get Tax Help at the end of this You can use the following general rule as a

prizes, and awards. You may also have to pay publication for information about how to get this guide during the year to see if you will have

estimated tax if the amount of income tax being publication and form. enough withholding, or should increase your

withheld from your salary, pension, or other in- withholding or make estimated tax payments.

come isn’t enough. Worksheets. You may need to use several of

Estimated tax is used to pay both income the blank worksheets included in this chapter. General Rule

tax and self-employment tax, as well as other See Worksheets for Chapter 2 to locate what

taxes and amounts reported on your tax return. you need. In most cases, you must pay estimated tax for

If you don’t pay enough tax, either through with-

holding or estimated tax, or a combination of 2020 if both of the following apply.

both, you may have to pay a penalty. If you Who Does Not Have To 1. You expect to owe at least $1,000 in tax

don’t pay enough by the due date of each pay- for 2020, after subtracting your withholding

ment period (see When To Pay Estimated Tax, Pay Estimated Tax and tax credits.

later), you may be charged a penalty even if you

are due a refund when you file your tax return. If you receive salaries and wages, you may be 2. You expect your withholding and tax cred-

For information on when the penalty applies, able to avoid paying estimated tax by asking its to be less than the smaller of:

see the Instructions for Form 2210. your employer to take more tax out of your a. 90% of the tax to be shown on your

It would be helpful for you to have a earnings. To do this, file a new Form W-4 with 2020 tax return, or

your employer. See chapter 1.

TIP copy of your 2019 tax return and an es- b. 100% of the tax shown on your 2019

timate of your 2020 income nearby tax return. Your 2019 tax return must

while reading this chapter. Also, keep in mind Estimated tax not required. You don’t have cover all 12 months.

the items under What’s New for 2020, earlier. to pay estimated tax for 2020 if you meet all

three of the following conditions. Note. The percentages in (2a) or (2b) just listed

• You had no tax liability for 2019. may be different if you are a farmer, fisherman,

Page 22 Chapter 2 Estimated Tax for 2020