Page 20 - Tax withholding and Estimated Taxes

P. 20

Page 18 of 47

Fileid: … tions/P505/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

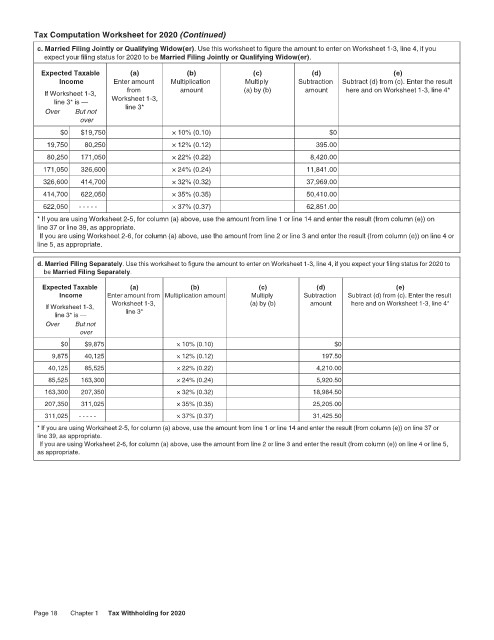

Tax Computation Worksheet for 2020 (Continued) 12:15 - 17-Jun-2020

c. Married Filing Jointly or Qualifying Widow(er). Use this worksheet to figure the amount to enter on Worksheet 1-3, line 4, if you

expect your filing status for 2020 to be Married Filing Jointly or Qualifying Widow(er).

Expected Taxable (a) (b) (c) (d) (e)

Income Enter amount Multiplication Multiply Subtraction Subtract (d) from (c). Enter the result

If Worksheet 1-3, from amount (a) by (b) amount here and on Worksheet 1-3, line 4*

line 3* is — Worksheet 1-3,

Over But not line 3*

over

$0 $19,750 × 10% (0.10) $0

19,750 80,250 × 12% (0.12) 395.00

80,250 171,050 × 22% (0.22) 8,420.00

171,050 326,600 × 24% (0.24) 11,841.00

326,600 414,700 × 32% (0.32) 37,969.00

414,700 622,050 × 35% (0.35) 50,410.00

622,050 - - - - - × 37% (0.37) 62,851.00

* If you are using Worksheet 2-5, for column (a) above, use the amount from line 1 or line 14 and enter the result (from column (e)) on

line 37 or line 39, as appropriate.

If you are using Worksheet 2-6, for column (a) above, use the amount from line 2 or line 3 and enter the result (from column (e)) on line 4 or

line 5, as appropriate.

d. Married Filing Separately. Use this worksheet to figure the amount to enter on Worksheet 1-3, line 4, if you expect your filing status for 2020 to

be Married Filing Separately.

Expected Taxable (a) (b) (c) (d) (e)

Income Enter amount from Multiplication amount Multiply Subtraction Subtract (d) from (c). Enter the result

If Worksheet 1-3, Worksheet 1-3, (a) by (b) amount here and on Worksheet 1-3, line 4*

line 3* is — line 3*

Over But not

over

$0 $9,875 × 10% (0.10) $0

9,875 40,125 × 12% (0.12) 197.50

40,125 85,525 × 22% (0.22) 4,210.00

85,525 163,300 × 24% (0.24) 5,920.50

163,300 207,350 × 32% (0.32) 18,984.50

207,350 311,025 × 35% (0.35) 25,205.00

311,025 - - - - - × 37% (0.37) 31,425.50

* If you are using Worksheet 2-5, for column (a) above, use the amount from line 1 or line 14 and enter the result (from column (e)) on line 37 or

line 39, as appropriate.

If you are using Worksheet 2-6, for column (a) above, use the amount from line 2 or line 3 and enter the result (from column (e)) on line 4 or line 5,

as appropriate.

Page 18 Chapter 1 Tax Withholding for 2020