Page 16 - Tax withholding and Estimated Taxes

P. 16

Page 14 of 47

Fileid: … tions/P505/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Worksheets for Chapter 1 12:15 - 17-Jun-2020

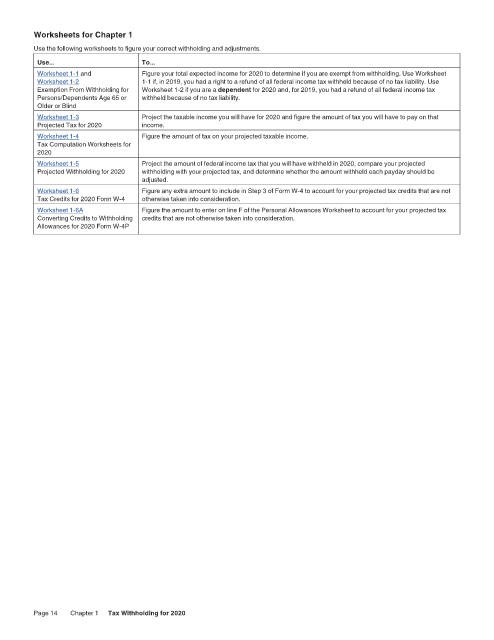

Use the following worksheets to figure your correct withholding and adjustments.

Use... To...

Worksheet 1-1 and Figure your total expected income for 2020 to determine if you are exempt from withholding. Use Worksheet

Worksheet 1-2 1-1 if, in 2019, you had a right to a refund of all federal income tax withheld because of no tax liability. Use

Exemption From Withholding for Worksheet 1-2 if you are a dependent for 2020 and, for 2019, you had a refund of all federal income tax

Persons/Dependents Age 65 or withheld because of no tax liability.

Older or Blind

Worksheet 1-3 Project the taxable income you will have for 2020 and figure the amount of tax you will have to pay on that

Projected Tax for 2020 income.

Worksheet 1-4 Figure the amount of tax on your projected taxable income.

Tax Computation Worksheets for

2020

Worksheet 1-5 Project the amount of federal income tax that you will have withheld in 2020, compare your projected

Projected Withholding for 2020 withholding with your projected tax, and determine whether the amount withheld each payday should be

adjusted.

Worksheet 1-6 Figure any extra amount to include in Step 3 of Form W-4 to account for your projected tax credits that are not

Tax Credits for 2020 Form W-4 otherwise taken into consideration.

Worksheet 1-6A Figure the amount to enter on line F of the Personal Allowances Worksheet to account for your projected tax

Converting Credits to Withholding credits that are not otherwise taken into consideration.

Allowances for 2020 Form W-4P

Page 14 Chapter 1 Tax Withholding for 2020