Page 17 - Tax withholding and Estimated Taxes

P. 17

Page 15 of 47

Fileid: … tions/P505/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

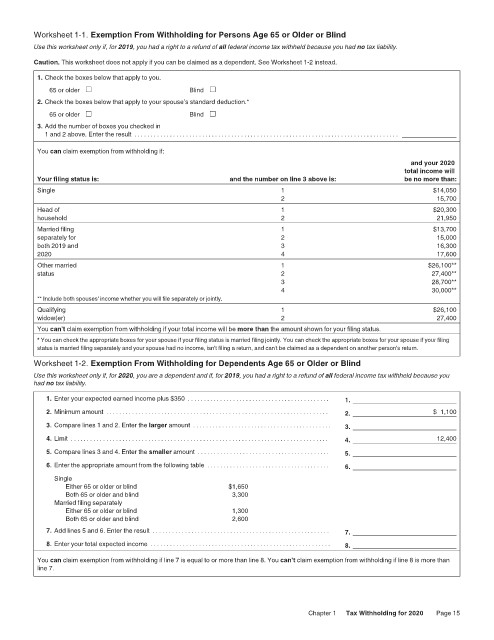

Worksheet 1-1. Exemption From Withholding for Persons Age 65 or Older or Blind 12:15 - 17-Jun-2020

Use this worksheet only if, for 2019, you had a right to a refund of all federal income tax withheld because you had no tax liability.

Caution. This worksheet does not apply if you can be claimed as a dependent. See Worksheet 1-2 instead.

1. Check the boxes below that apply to you.

65 or older Blind

2. Check the boxes below that apply to your spouse’s standard deduction.*

65 or older Blind

3. Add the number of boxes you checked in

1 and 2 above. Enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

You can claim exemption from withholding if:

and your 2020

total income will

Your filing status is: and the number on line 3 above is: be no more than:

Single 1 $14,050

2 15,700

Head of 1 $20,300

household 2 21,950

Married filing 1 $13,700

separately for 2 15,000

both 2019 and 3 16,300

2020 4 17,600

Other married 1 $26,100**

status 2 27,400**

3 28,700**

4 30,000**

** Include both spouses' income whether you will file separately or jointly.

Qualifying 1 $26,100

widow(er) 2 27,400

You can’t claim exemption from withholding if your total income will be more than the amount shown for your filing status.

* You can check the appropriate boxes for your spouse if your filing status is married filing jointly. You can check the appropriate boxes for your spouse if your filing

status is married filing separately and your spouse had no income, isn't filing a return, and can't be claimed as a dependent on another person's return.

Worksheet 1-2. Exemption From Withholding for Dependents Age 65 or Older or Blind

Use this worksheet only if, for 2020, you are a dependent and if, for 2019, you had a right to a refund of all federal income tax withheld because you

had no tax liability.

1. Enter your expected earned income plus $350 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Minimum amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ 1,100

3. Compare lines 1 and 2. Enter the larger amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Limit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. 12,400

5. Compare lines 3 and 4. Enter the smaller amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. Enter the appropriate amount from the following table . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

Single

Either 65 or older or blind $1,650

Both 65 or older and blind 3,300

Married filing separately

Either 65 or older or blind 1,300

Both 65 or older and blind 2,600

7. Add lines 5 and 6. Enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Enter your total expected income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

You can claim exemption from withholding if line 7 is equal to or more than line 8. You can’t claim exemption from withholding if line 8 is more than

line 7.

Chapter 1 Tax Withholding for 2020 Page 15