Page 48 - Tax withholding and Estimated Taxes

P. 48

12:15 - 17-Jun-2020

Page 46 of 47

Fileid: … tions/P505/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

To help us develop a more useful index, please let us know if you have ideas for index entries.

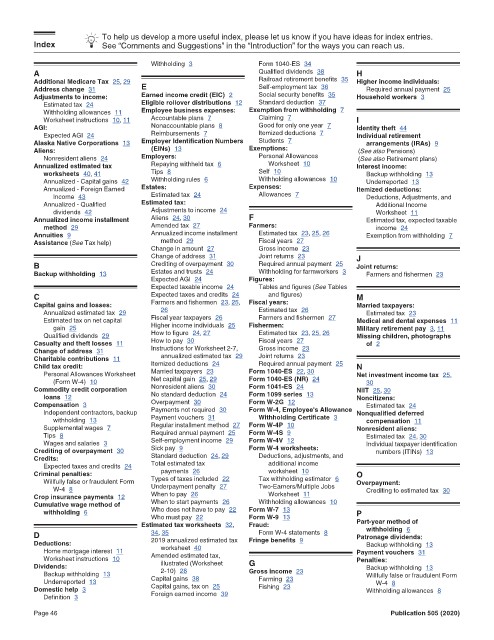

Index See “Comments and Suggestions” in the “Introduction” for the ways you can reach us.

Withholding 3 Form 1040-ES 34

A Qualified dividends 38 H

Additional Medicare Tax 25, 29 Railroad retirement benefits 35 Higher income individuals:

Address change 31 E Self-employment tax 36 Required annual payment 25

Adjustments to income: Earned income credit (EIC) 2 Social security benefits 35 Household workers 3

Estimated tax 24 Eligible rollover distributions 12 Standard deduction 37

Withholding allowances 11 Employee business expenses: Exemption from withholding 7

Worksheet instructions 10, 11 Accountable plans 7 Claiming 7 I

AGI: Nonaccountable plans 8 Good for only one year 7 Identity theft 44

Expected AGI 24 Reimbursements 7 Itemized deductions 7 Individual retirement

Alaska Native Corporations 13 Employer Identification Numbers Students 7 arrangements (IRAs) 9

Aliens: (EINs) 13 Exemptions: (See also Pensions)

Nonresident aliens 24 Employers: Personal Allowances (See also Retirement plans)

Annualized estimated tax Repaying withheld tax 6 Worksheet 10 Interest income:

worksheets 40, 41 Tips 8 Self 10 Backup withholding 13

Annualized - Capital gains 42 Withholding rules 6 Withholding allowances 10 Underreported 13

Annualized - Foreign Earned Estates: Expenses: Itemized deductions:

Income 43 Estimated tax 24 Allowances 7 Deductions, Adjustments, and

Annualized - Qualified Estimated tax: Additional Income

dividends 42 Adjustments to income 24 Worksheet 11

Annualized income installment Aliens 24, 30 F Estimated tax, expected taxable

method 29 Amended tax 27 Farmers: income 24

Annuities 9 Annualized income installment Estimated tax 23, 25, 26 Exemption from withholding 7

Assistance (See Tax help) method 29 Fiscal years 27

Change in amount 27 Gross income 23

Change of address 31 Joint returns 23 J

B Crediting of overpayment 30 Required annual payment 25 Joint returns:

Backup withholding 13 Estates and trusts 24 Withholding for farmworkers 3 Farmers and fishermen 23

Expected AGI 24 Figures:

Expected taxable income 24 Tables and figures (See Tables

C Expected taxes and credits 24 and figures) M

Capital gains and losses: Farmers and fishermen 23, 25, Fiscal years: Married taxpayers:

Annualized estimated tax 29 26 Estimated tax 26 Estimated tax 23

Estimated tax on net capital Fiscal year taxpayers 26 Farmers and fishermen 27 Medical and dental expenses 11

gain 25 Higher income individuals 25 Fishermen: Military retirement pay 3, 11

Qualified dividends 29 How to figure 24, 27 Estimated tax 23, 25, 26 Missing children, photographs

Casualty and theft losses 11 How to pay 30 Fiscal years 27 of 2

Change of address 31 Instructions for Worksheet 2-7, Gross income 23

Charitable contributions 11 annualized estimated tax 29 Joint returns 23

Child tax credit: Itemized deductions 24 Required annual payment 25 N

Personal Allowances Worksheet Married taxpayers 23 Form 1040-ES 22, 30 Net investment income tax 25,

(Form W-4) 10 Net capital gain 25, 29 Form 1040-ES (NR) 24 30

Commodity credit corporation Nonresident aliens 30 Form 1041-ES 24 NIIT 25, 30

loans 12 No standard deduction 24 Form 1099 series 13 Noncitizens:

Compensation 3 Overpayment 30 Form W-2G 12 Estimated tax 24

Independent contractors, backup Payments not required 30 Form W-4, Employee's Allowance Nonqualified deferred

withholding 13 Payment vouchers 31 Withholding Certificate 3 compensation 11

Supplemental wages 7 Regular installment method 27 Form W-4P 10 Nonresident aliens:

Tips 8 Required annual payment 25 Form W-4S 9 Estimated tax 24, 30

Wages and salaries 3 Self-employment income 29 Form W-4V 12 Individual taxpayer identification

Crediting of overpayment 30 Sick pay 9 Form W-4 worksheets: numbers (ITINs) 13

Credits: Standard deduction 24, 29 Deductions, adjustments, and

Expected taxes and credits 24 Total estimated tax additional income

Criminal penalties: payments 26 worksheet 10 O

Willfully false or fraudulent Form Types of taxes included 22 Tax withholding estimator 6 Overpayment:

W-4 8 Underpayment penalty 27 Two-Earners/Multiple Jobs Crediting to estimated tax 30

Crop insurance payments 12 When to pay 26 Worksheet 11

Cumulative wage method of When to start payments 26 Withholding allowances 10

withholding 6 Who does not have to pay 22 Form W-7 13 P

Who must pay 22

Form W-9 13

Estimated tax worksheets 32, Fraud: Part-year method of

withholding 6

D 34, 35 Form W-4 statements 8 Patronage dividends:

Deductions: 2019 annualized estimated tax Fringe benefits 9 Backup withholding 13

Home mortgage interest 11 worksheet 40 Payment vouchers 31

Worksheet instructions 10 Amended estimated tax, Penalties:

Dividends: illustrated (Worksheet G Backup withholding 13

Backup withholding 13 2-10) 28 Gross income 23 Willfully false or fraudulent Form

Underreported 13 Capital gains 38 Farming 23 W-4 8

Domestic help 3 Capital gains, tax on 25 Fishing 23 Withholding allowances 8

Definition 3 Foreign earned income 39

Page 46 Publication 505 (2020)