Page 49 - Tax withholding and Estimated Taxes

P. 49

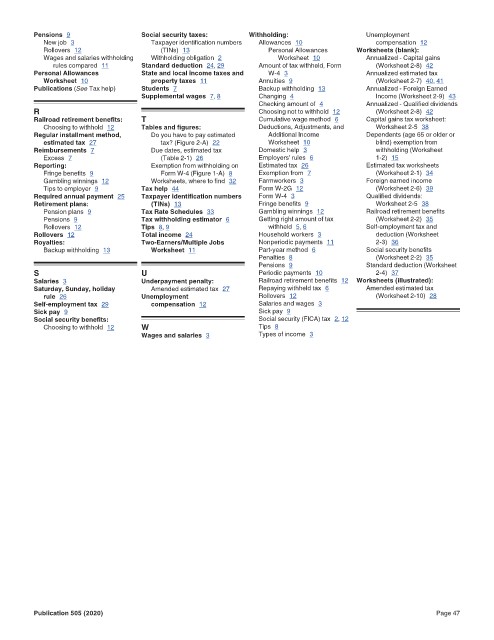

Page 47 of 47

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Withholding:

Social security taxes:

Pensions 9 Fileid: … tions/P505/2020/A/XML/Cycle03/source 12:15 - 17-Jun-2020

Unemployment

New job 3 Taxpayer identification numbers Allowances 10 compensation 12

Rollovers 12 (TINs) 13 Personal Allowances Worksheets (blank):

Wages and salaries withholding Withholding obligation 2 Worksheet 10 Annualized - Capital gains

rules compared 11 Standard deduction 24, 29 Amount of tax withheld, Form (Worksheet 2-8) 42

Personal Allowances State and local income taxes and W-4 3 Annualized estimated tax

Worksheet 10 property taxes 11 Annuities 9 (Worksheet 2-7) 40, 41

Publications (See Tax help) Students 7 Backup withholding 13 Annualized - Foreign Earned

Supplemental wages 7, 8 Changing 4 Income (Worksheet 2-9) 43

Checking amount of 4 Annualized - Qualified dividends

R Choosing not to withhold 12 (Worksheet 2-8) 42

Railroad retirement benefits: T Cumulative wage method 6 Capital gains tax worksheet:

Choosing to withhold 12 Tables and figures: Deductions, Adjustments, and Worksheet 2-5 38

Regular installment method, Do you have to pay estimated Additional Income Dependents (age 65 or older or

estimated tax 27 tax? (Figure 2-A) 22 Worksheet 10 blind) exemption from

Reimbursements 7 Due dates, estimated tax Domestic help 3 withholding (Worksheet

Excess 7 (Table 2-1) 26 Employers' rules 6 1-2) 15

Reporting: Exemption from withholding on Estimated tax 26 Estimated tax worksheets

Fringe benefits 9 Form W-4 (Figure 1-A) 8 Exemption from 7 (Worksheet 2-1) 34

Gambling winnings 12 Worksheets, where to find 32 Farmworkers 3 Foreign earned income

Tips to employer 9 Tax help 44 Form W-2G 12 (Worksheet 2-6) 39

Required annual payment 25 Taxpayer identification numbers Form W-4 3 Qualified dividends:

Retirement plans: (TINs) 13 Fringe benefits 9 Worksheet 2-5 38

Pension plans 9 Tax Rate Schedules 33 Gambling winnings 12 Railroad retirement benefits

Pensions 9 Tax withholding estimator 6 Getting right amount of tax (Worksheet 2-2) 35

Rollovers 12 Tips 8, 9 withheld 5, 6 Self-employment tax and

Rollovers 12 Total income 24 Household workers 3 deduction (Worksheet

Royalties: Two-Earners/Multiple Jobs Nonperiodic payments 11 2-3) 36

Backup withholding 13 Worksheet 11 Part-year method 6 Social security benefits

Penalties 8 (Worksheet 2-2) 35

Pensions 9 Standard deduction (Worksheet

S U Periodic payments 10 2-4) 37

Salaries 3 Underpayment penalty: Railroad retirement benefits 12 Worksheets (illustrated):

Saturday, Sunday, holiday Amended estimated tax 27 Repaying withheld tax 6 Amended estimated tax

rule 26 Unemployment Rollovers 12 (Worksheet 2-10) 28

Self-employment tax 29 compensation 12 Salaries and wages 3

Sick pay 9 Sick pay 9

Social security benefits: Social security (FICA) tax 2, 12

Choosing to withhold 12 W Tips 8

Wages and salaries 3 Types of income 3

Publication 505 (2020) Page 47