Page 60 - Acertaining Economic Damages Calculation

P. 60

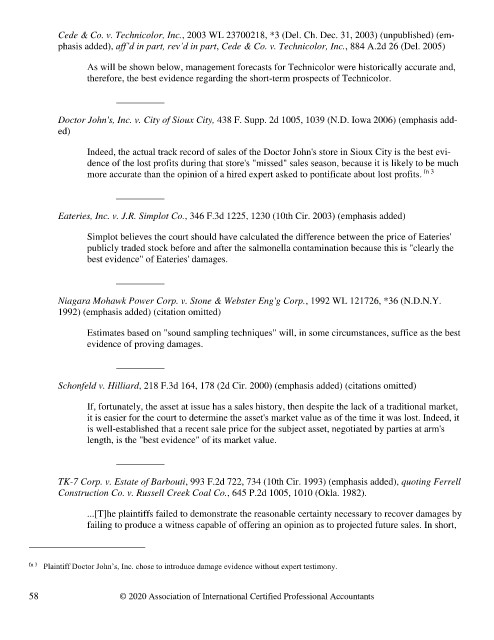

Cede & Co. v. Technicolor, Inc., 2003 WL 23700218, *3 (Del. Ch. Dec. 31, 2003) (unpublished) (em-

phasis added), aff’d in part, rev’d in part, Cede & Co. v. Technicolor, Inc., 884 A.2d 26 (Del. 2005)

As will be shown below, management forecasts for Technicolor were historically accurate and,

therefore, the best evidence regarding the short-term prospects of Technicolor.

__________

Doctor John's, Inc. v. City of Sioux City, 438 F. Supp. 2d 1005, 1039 (N.D. Iowa 2006) (emphasis add-

ed)

Indeed, the actual track record of sales of the Doctor John's store in Sioux City is the best evi-

dence of the lost profits during that store's "missed" sales season, because it is likely to be much

more accurate than the opinion of a hired expert asked to pontificate about lost profits. fn 3

__________

Eateries, Inc. v. J.R. Simplot Co., 346 F.3d 1225, 1230 (10th Cir. 2003) (emphasis added)

Simplot believes the court should have calculated the difference between the price of Eateries'

publicly traded stock before and after the salmonella contamination because this is "clearly the

best evidence" of Eateries' damages.

__________

Niagara Mohawk Power Corp. v. Stone & Webster Eng'g Corp., 1992 WL 121726, *36 (N.D.N.Y.

1992) (emphasis added) (citation omitted)

Estimates based on "sound sampling techniques" will, in some circumstances, suffice as the best

evidence of proving damages.

__________

Schonfeld v. Hilliard, 218 F.3d 164, 178 (2d Cir. 2000) (emphasis added) (citations omitted)

If, fortunately, the asset at issue has a sales history, then despite the lack of a traditional market,

it is easier for the court to determine the asset's market value as of the time it was lost. Indeed, it

is well-established that a recent sale price for the subject asset, negotiated by parties at arm's

length, is the "best evidence" of its market value.

__________

TK-7 Corp. v. Estate of Barbouti, 993 F.2d 722, 734 (10th Cir. 1993) (emphasis added), quoting Ferrell

Construction Co. v. Russell Creek Coal Co., 645 P.2d 1005, 1010 (Okla. 1982).

...[T]he plaintiffs failed to demonstrate the reasonable certainty necessary to recover damages by

failing to produce a witness capable of offering an opinion as to projected future sales. In short,

fn 3 Plaintiff Doctor John’s, Inc. chose to introduce damage evidence without expert testimony.

58 © 2020 Association of International Certified Professional Accountants