Page 308 - TaxAdviser_2022

P. 308

INTEREST INCOME & EXPENSE

Companies that in previous years have narrowly avoided this interest

deductibility limitation should be aware that the limitation is more

restrictive for tax years starting after 2021.

Understanding this reclassification significant portion of business-to- entities have elected not to go through

strategy for raising the interest deduc- business transactions involves trade the necessary analysis to allocate the

tion ceiling requires first taking several receivables and payables and can be contract price. However, if a company

steps back. In May 2014, FASB issued considered a form of financing provided were to take on this burden to allocate a

5

Accounting Standards Update No. to the buyer by the seller. According portion of the contracted sales price to

2014-09, Revenue From Contracts With to Topic 606, the entity should present interest income, it would effectively be

Customers (Topic 606). This guidance the effect of financing separately from reclassifying a small portion of its rev-

provides a framework for companies revenues derived from sales contracts enues as business interest income.

6

across various industries to recognize with customers. As this could be con-

revenues on a more consistent basis. sidered burdensome, firms are allowed Separately identifying the

Within this framework, entities are to adopt a “practical expedient” and not financing component

required to identify the transaction price separately report the effect of financing How can a seller that wants to use this

and various performance obligations, for receivables expected to be collected reclassification strategy to increase its

7

then allocate the transaction price across within one year. Due to the availability Sec. 163(j) limit allocate the transaction

the identified performance obligations. 4 of this practical expedient and the fact price between the sale of the good or

Importantly for the reclassification that most business-to-business receiv- service and the financing component?

strategy under consideration here, a ables are collected within one year, most There are a few situations where a

4. Under ASC Paragraph 606-10-32-3, an entity is required to “consider the 5. FASB ASC Subtopic 310-10.

effects of all of the following” to determine the transaction price: (1) variable 6. ASC Paragraph 606-10-32-20.

consideration; (2) constraining estimates of variable consideration; (3) the 7. ASC Paragraph 606-10-32-18.

existence of a significant financing component in the contract; (4) noncash

consideration; and (5) consideration payable to a customer.

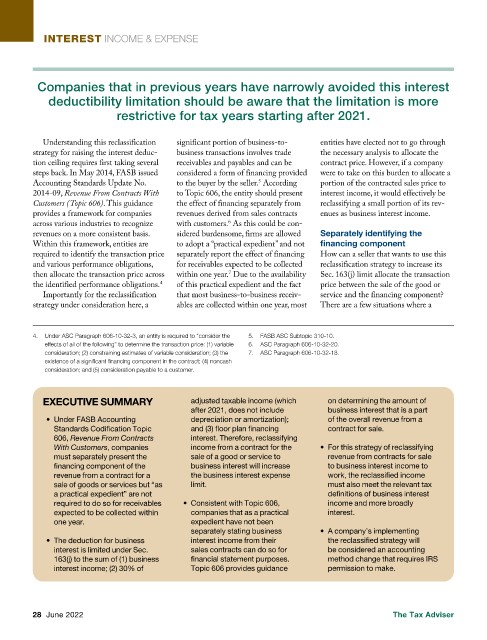

EXECUTIVE SUMMARY adjusted taxable income (which on determining the amount of

after 2021, does not include business interest that is a part

• Under FASB Accounting depreciation or amortization); of the overall revenue from a

Standards Codification Topic and (3) floor plan financing contract for sale.

606, Revenue From Contracts interest. Therefore, reclassifying

With Customers, companies income from a contract for the • For this strategy of reclassifying

must separately present the sale of a good or service to revenue from contracts for sale

financing component of the business interest will increase to business interest income to

revenue from a contract for a the business interest expense work, the reclassified income

sale of goods or services but “as limit. must also meet the relevant tax

a practical expedient” are not definitions of business interest

required to do so for receivables • Consistent with Topic 606, income and more broadly

expected to be collected within companies that as a practical interest.

one year. expedient have not been

separately stating business • A company’s implementing

• The deduction for business interest income from their the reclassified strategy will

interest is limited under Sec. sales contracts can do so for be considered an accounting

163(j) to the sum of (1) business financial statement purposes. method change that requires IRS

interest income; (2) 30% of Topic 606 provides guidance permission to make.

28 June 2022 The Tax Adviser