Page 311 - TaxAdviser_2022

P. 311

provides that a change of a material item

affecting timing is a change in account- Businesses should not opt for the

ing method and generally requires the

IRS’s permission to change. However, practical expedient if they wish to pursue

various IRS revenue procedures allow for the strategy being discussed here to raise

certain changes to be made automatically,

without express permission. Although the Sec. 163(j) interest deduction ceiling,

because, for this approach to work, it is

the contemplated reclassification of in-

come into the business interest category necessary to separately identify business

involves items within a single year, the

interest income.

effect it would have on the carryforward

amount has timing implications and

would be considered a change in ac-

counting method. If the change follows this reclassification would be to allow annual receivables of $400 million;

financial accounting treatment, then the the company to increase the deductible and a cost of capital implicit in the

change would most likely be automatic amount of interest expense by up to 70% receivables of 5%. (See the table “Ex-

and would not require IRS permission. 12 for each dollar recognized as interest in- ample Assumptions” below.)

How would such a reclassification come instead of traditional revenues.

of revenues impact the interest expense The table “Excerpts From Form

limitation of Sec. 163(j)? The interest Illustrative example 1120” on p. 32 presents excerpts from

expense deduction, as noted earlier, is To illustrate the potential impact of this Form 1120, U.S. Corporation Income

limited to the sum of (1) business interest choice, consider the following example: Tax Return, under two scenarios for tax

income; (2) 30% of the adjusted taxable years 2021 and 2022 using the assumed

income; and (3) floor plan financing Example: A firm has gross receipts of facts. The notable difference between

interest. Business interest income is $1 billion; cost of goods sold (COGS) these years is that for 2022 the ad-

included in the interest limitation calcu- of $600 million; various business dback of depreciation, amortization,

lation at 100%, while traditional revenues deductions (excluding depreciation, and depletion is removed from the cal-

flow into adjusted taxable income, which amortization, and depletion) of $275 culation of the limitation on business

is included in the interest limitation million; depreciation, amortization, interest expense. The table “Excerpts

calculation at only 30%. The effect of and depletion of $50 million; average From Form 8990” on p. 32 presents

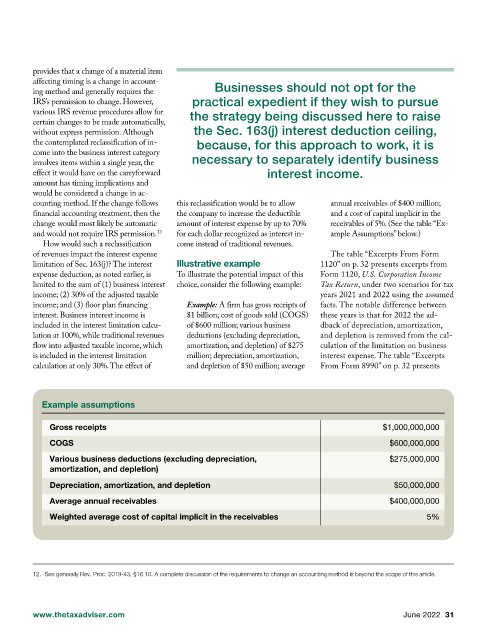

Example assumptions

Gross receipts $1,000,000,000

COGS $600,000,000

Various business deductions (excluding depreciation, $275,000,000

amortization, and depletion)

Depreciation, amortization, and depletion $50,000,000

Average annual receivables $400,000,000

Weighted average cost of capital implicit in the receivables 5%

12. See generally Rev. Proc. 2019-43, §16.10. A complete discussion of the requirements to change an accounting method is beyond the scope of this article.

www.thetaxadviser.com June 2022 31