Page 312 - TaxAdviser_2022

P. 312

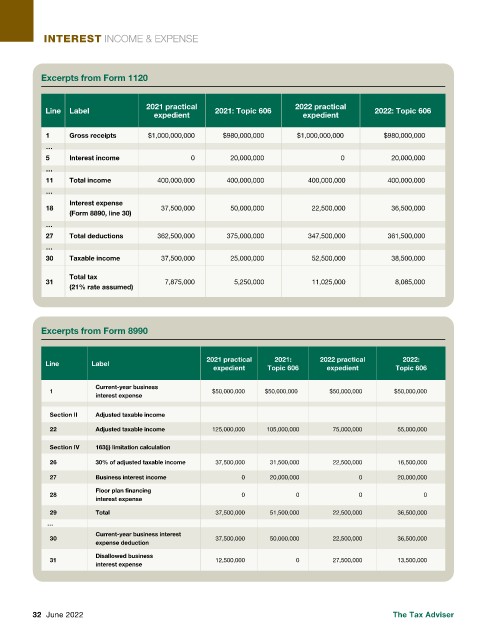

INTEREST INCOME & EXPENSE

Excerpts from Form 1120

2021 practical 2022 practical

Line Label 2021: Topic 606 2022: Topic 606

expedient expedient

1 Gross receipts $1,000,000,000 $980,000,000 $1,000,000,000 $980,000,000

…

5 Interest income 0 20,000,000 0 20,000,000

…

11 Total income 400,000,000 400,000,000 400,000,000 400,000,000

…

Interest expense

18 37,500,000 50,000,000 22,500,000 36,500,000

(Form 8890, line 30)

…

27 Total deductions 362,500,000 375,000,000 347,500,000 361,500,000

…

30 Taxable income 37,500,000 25,000,000 52,500,000 38,500,000

Total tax

31 7,875,000 5,250,000 11,025,000 8,085,000

(21% rate assumed)

Excerpts from Form 8990

2021 practical 2021: 2022 practical 2022:

Line Label

expedient Topic 606 expedient Topic 606

Current-year business

1 $50,000,000 $50,000,000 $50,000,000 $50,000,000

interest expense

Section II Adjusted taxable income

22 Adjusted taxable income 125,000,000 105,000,000 75,000,000 55,000,000

Section IV 163(j) limitation calculation

26 30% of adjusted taxable income 37,500,000 31,500,000 22,500,000 16,500,000

27 Business interest income 0 20,000,000 0 20,000,000

Floor plan financing

28 0 0 0 0

interest expense

29 Total 37,500,000 51,500,000 22,500,000 36,500,000

…

Current-year business interest

30 37,500,000 50,000,000 22,500,000 36,500,000

expense deduction

Disallowed business

31 12,500,000 0 27,500,000 13,500,000

interest expense

32 June 2022 The Tax Adviser