Page 356 - TaxAdviser_2022

P. 356

including state and local taxes and em- and the other adjustments account

ployee compensation to shareholders, are (OAA) due to accumulated earnings and

deducted against nonseparately stated profits (AE&P). In Letter Ruling

items of income and pass through to the These matters were addressed in the 202110010,

shareholder(s) as net ordinary income revenue procedures issued in Novem- the IRS concluded

or loss. ber 2021.

Timing issues under the CAA: that the terms of the

Timing of PPP deductions and Before describing the revenue proce- operating agreement

effect on AAA, AE&P, and OAA dures in more detail, it may be helpful to

Issued Nov. 18, 2021, Rev. Procs. illustrate the timing issues arising under created a second

class of stock for

2021-48, 2021-49, and 2021-50 ad- the CAA.

dressed the timing treatment of tax- the S corporation.

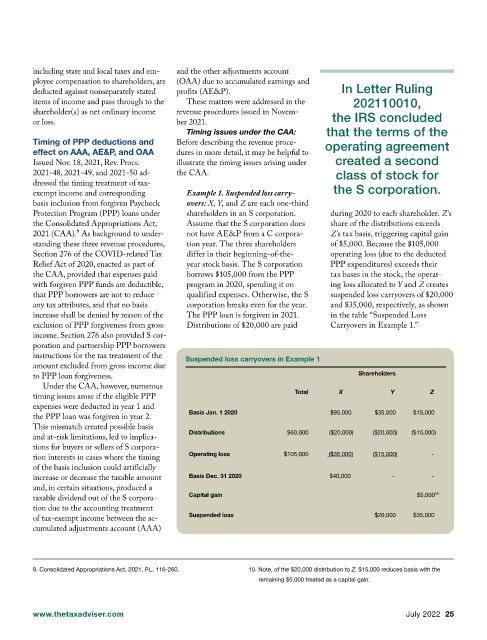

exempt income and corresponding Example 1. Suspended loss carry-

basis inclusion from forgiven Paycheck overs: X, Y, and Z are each one-third

Protection Program (PPP) loans under shareholders in an S corporation. during 2020 to each shareholder. Z’s

the Consolidated Appropriations Act, Assume that the S corporation does share of the distributions exceeds

2021 (CAA).9 As background to under- not have AE&P from a C corpora- Z’s tax basis, triggering capital gain

standing these three revenue procedures, tion year. The three shareholders of $5,000. Because the $105,000

Section 276 of the COVID-related Tax differ in their beginning-of-the- operating loss (due to the deducted

Relief Act of 2020, enacted as part of year stock basis. The S corporation PPP expenditures) exceeds their

the CAA, provided that expenses paid borrows $105,000 from the PPP tax bases in the stock, the operat-

with forgiven PPP funds are deductible, program in 2020, spending it on ing loss allocated to Y and Z creates

that PPP borrowers are not to reduce qualified expenses. Otherwise, the S suspended loss carryovers of $20,000

any tax attributes, and that no basis corporation breaks even for the year. and $35,000, respectively, as shown

increase shall be denied by reason of the The PPP loan is forgiven in 2021. in the table “Suspended Loss

exclusion of PPP forgiveness from gross Distributions of $20,000 are paid Carryovers in Example 1.”

income. Section 276 also provided S cor-

poration and partnership PPP borrowers

instructions for the tax treatment of the Suspended loss carryovers in Example 1

amount excluded from gross income due

Shareholders

to PPP loan forgiveness.

Under the CAA, however, numerous

Total X Y Z

timing issues arose if the eligible PPP

expenses were deducted in year 1 and

Basis Jan. 1 2020 $95,000 $35,000 $15,000

the PPP loan was forgiven in year 2.

This mismatch created possible basis

Distributions $60,000 ($20,000) ($20,000) ($15,000)

and at-risk limitations, led to implica-

tions for buyers or sellers of S corpora-

Operating loss $105,000 ($35,000) ($15,000) -

tion interests in cases where the timing

of the basis inclusion could artificially

increase or decrease the taxable amount Basis Dec. 31 2020 $40,000 - -

and, in certain situations, produced a

Capital gain $5,00010

taxable dividend out of the S corpora-

tion due to the accounting treatment

Suspended loss $20,000 $35,000

of tax-exempt income between the ac-

cumulated adjustments account (AAA)

9. Consolidated Appropriations Act, 2021, P.L. 116-260. 10. Note, of the $20,000 distribution to Z, $15,000 reduces basis with the

remaining $5,000 treated as a capital gain.

www.thetaxadviser.com July 2022 25