Page 357 - TaxAdviser_2022

P. 357

S CORPORATIONS

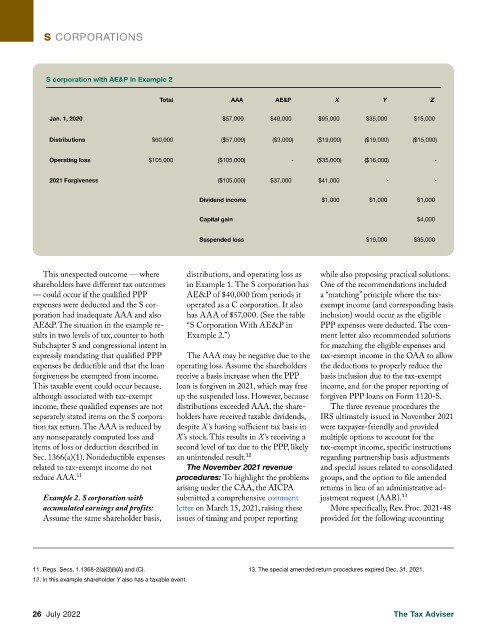

S corporation with AE&P in Example 2

Total AAA AE&P X Y Z

Jan. 1, 2020 $57,000 $40,000 $95,000 $35,000 $15,000

Distributions $60,000 ($57,000) ($3,000) ($19,000) ($19,000) ($15,000)

Operating loss $105,000 ($105,000) - ($35,000) ($16,000) -

2021 Forgiveness ($105,000) $37,000 $41,000 - -

Dividend income $1,000 $1,000 $1,000

Capital gain $4,000

Suspended loss $19,000 $35,000

This unexpected outcome — where distributions, and operating loss as while also proposing practical solutions.

shareholders have different tax outcomes in Example 1. The S corporation has One of the recommendations included

— could occur if the qualified PPP AE&P of $40,000 from periods it a “matching” principle where the tax-

expenses were deducted and the S cor- operated as a C corporation. It also exempt income (and corresponding basis

poration had inadequate AAA and also has AAA of $57,000. (See the table inclusion) would occur as the eligible

AE&P. The situation in the example re- “S Corporation With AE&P in PPP expenses were deducted. The com-

sults in two levels of tax, counter to both Example 2.”) ment letter also recommended solutions

Subchapter S and congressional intent in for matching the eligible expenses and

expressly mandating that qualified PPP The AAA may be negative due to the tax-exempt income in the OAA to allow

expenses be deductible and that the loan operating loss. Assume the shareholders the deductions to properly reduce the

forgiveness be exempted from income. receive a basis increase when the PPP basis inclusion due to the tax-exempt

This taxable event could occur because, loan is forgiven in 2021, which may free income, and for the proper reporting of

although associated with tax-exempt up the suspended loss. However, because forgiven PPP loans on Form 1120-S.

income, these qualified expenses are not distributions exceeded AAA, the share- The three revenue procedures the

separately stated items on the S corpora- holders have received taxable dividends, IRS ultimately issued in November 2021

tion tax return. The AAA is reduced by despite X’s having sufficient tax basis in were taxpayer-friendly and provided

any nonseparately computed loss and X’s stock. This results in X’s receiving a multiple options to account for the

items of loss or deduction described in second level of tax due to the PPP, likely tax-exempt income, specific instructions

Sec. 1366(a)(1). Nondeductible expenses an unintended result.12 regarding partnership basis adjustments

related to tax-exempt income do not The November 2021 revenue and special issues related to consolidated

reduce AAA.11 procedures: To highlight the problems groups, and the option to file amended

arising under the CAA, the AICPA returns in lieu of an administrative ad-

Example 2. S corporation with submitted a comprehensive comment justment request (AAR).13

accumulated earnings and profits: letter on March 15, 2021, raising these More specifically, Rev. Proc. 2021-48

Assume the same shareholder basis, issues of timing and proper reporting provided for the following accounting

11. Regs. Secs. 1.1368-2(a)(3)(i)(A) and (C). 13. The special amended return procedures expired Dec. 31, 2021.

12. In this example shareholder Y also has a taxable event.

26 July 2022 The Tax Adviser