Page 40 - TaxAdviser_2022

P. 40

TAX PRACTICE & PROCEDURES

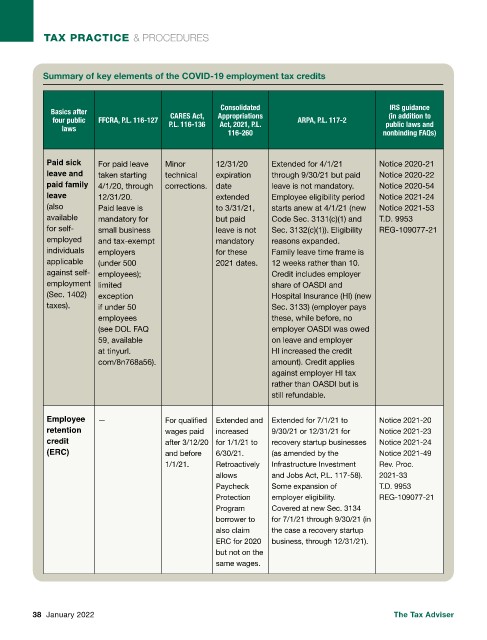

Summary of key elements of the COVID-19 employment tax credits

Consolidated IRS guidance

Basics after CARES Act, Appropriations (in addition to

four public FFCRA, P.L. 116-127 P.L. 116-136 Act, 2021, P.L. ARPA, P.L. 117-2 public laws and

laws

116-260 nonbinding FAQs)

Paid sick For paid leave Minor 12/31/20 Extended for 4/1/21 Notice 2020-21

leave and taken starting technical expiration through 9/30/21 but paid Notice 2020-22

paid family 4/1/20, through corrections. date leave is not mandatory. Notice 2020-54

leave 12/31/20. extended Employee eligibility period Notice 2021-24

(also Paid leave is to 3/31/21, starts anew at 4/1/21 (new Notice 2021-53

available mandatory for but paid Code Sec. 3131(c)(1) and T.D. 9953

for self- small business leave is not Sec. 3132(c)(1)). Eligibility REG-109077-21

employed and tax-exempt mandatory reasons expanded.

individuals employers for these Family leave time frame is

applicable (under 500 2021 dates. 12 weeks rather than 10.

against self- employees); Credit includes employer

employment limited share of OASDI and

(Sec. 1402) exception Hospital Insurance (HI) (new

taxes). if under 50 Sec. 3133) (employer pays

employees these, while before, no

(see DOL FAQ employer OASDI was owed

59, available on leave and employer

at tinyurl. HI increased the credit

com/8n768a56). amount). Credit applies

against employer HI tax

rather than OASDI but is

still refundable.

Employee — For qualified Extended and Extended for 7/1/21 to Notice 2021-20

retention wages paid increased 9/30/21 or 12/31/21 for Notice 2021-23

credit after 3/12/20 for 1/1/21 to recovery startup businesses Notice 2021-24

(ERC) and before 6/30/21. (as amended by the Notice 2021-49

1/1/21. Retroactively Infrastructure Investment Rev. Proc.

allows and Jobs Act, P.L. 117-58). 2021-33

Paycheck Some expansion of T.D. 9953

Protection employer eligibility. REG-109077-21

Program Covered at new Sec. 3134

borrower to for 7/1/21 through 9/30/21 (in

also claim the case a recovery startup

ERC for 2020 business, through 12/31/21).

but not on the

same wages.

38 January 2022 The Tax Adviser