Page 410 - TaxAdviser_2022

P. 410

iven how central professional-

Ggrade return preparation software Results and methodology

is to tax practices, each year The Tax

The 2022 survey was conducted May 4–18. Invitations were sent by email to 75,553

Adviser and Journal of Accountancy ask

AICPA members who had indicated they have a professional interest in taxation. The

CPAs what product they use and how

results reflect answers of 1,778 respondents who said that they prepared tax year

it worked for them in the most recent 2021 returns for a fee.

season. For the 2022 season, seven

products again predominated, and they

are the ones tallied in most of this ■ ATX, 6.5%, up from 5.5% in 2021. 23%. At the other end of the spectrum

article’s charts and discussion. For last Lacerte and ProSeries are Intuit Inc. — firms of 501 or more tax preparers

products, while ATX, CCH Axcess Tax, — CCH Axcess Tax was the most used

year’s survey, see “2021 Tax Software

and CCH ProSystem fx are Wolters at 37% (and was used by only 3.7% of

Survey,” 52 The Tax Adviser 576

Kluwer products. UltraTax CS is a single-preparer firms) (see the table “Fa-

(September 2021).

Thomson Reuters product. vorites by Firm Size”). UltraTax CS and

The remaining six products Lacerte were the most consistent in their

Products covered and profile (GoSystem Tax RS, Intuit ProConnect proportion of use across all firm sizes.

of respondents Tax Online, TaxAct, TaxSlayer Pro, Similarly, the product used by

The survey allowed respondents to select TaxWise, and TurboTax) together ac- a firm tended to vary according to

among 13 listed products and to write in counted for 11.1% of responses, and the percentages of business versus

others. Those used by the greatest per- another 1.3% of respondents wrote in an individual returns that the firm prepared.

centages of respondents were: entry. For relative usage of all 13 products Individual returns were a majority of

■ UltraTax CS, 20%, down from 21.6% and more background on the seven major returns prepared by users of all major

in 2021; products, such as available packages and products, but that was true of 90% of

■ Drake Tax, 17.1%, about the same as their basic features, see “2022 Tax Soft- users of Drake Tax, followed by ATX

last year; ware Survey: Shares of Respondents and and ProSeries at 88.7% and 88.2%,

■ Lacerte, 13.3%, down from 14.6% in Product and Company Information.” respectively. Individual returns were

2021; The survey asked about the size of over half the workload for 61% of CCH

■ ProSeries, 12.8%, up from 11.4% in the firm in which respondents prepared Axcess Tax users and 67% of users of

2021; returns, as certain software products CCH ProSystem fx. Business returns

■ CCH Axcess Tax, 9.1%, the same as tend to be used in bigger or smaller were nearly 20% of the returns prepared

in 2021; firms. For example, Drake Tax was the by users of both CCH Axcess Tax and

■ CCH ProSystem fx, 8.8%, down from predominant choice among sole practi- CCH ProSystem fx. Business returns

9.2% last year; and tioners at 30%, followed by ProSeries at represented closer to the average of 10%

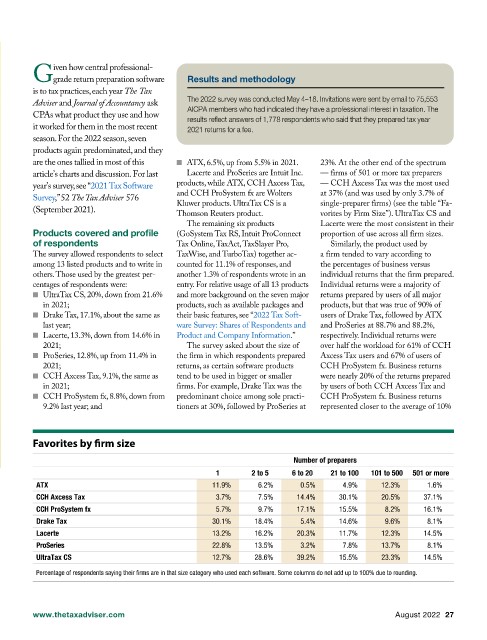

Favorites by firm size

Number of preparers

1 2 to 5 6 to 20 21 to 100 101 to 500 501 or more

ATX 11.9% 6.2% 0.5% 4.9% 12.3% 1.6%

CCH Axcess Tax 3.7% 7.5% 14.4% 30.1% 20.5% 37.1%

CCH ProSystem fx 5.7% 9.7% 17.1% 15.5% 8.2% 16.1%

Drake Tax 30.1% 18.4% 5.4% 14.6% 9.6% 8.1%

Lacerte 13.2% 16.2% 20.3% 11.7% 12.3% 14.5%

ProSeries 22.8% 13.5% 3.2% 7.8% 13.7% 8.1%

UltraTax CS 12.7% 28.6% 39.2% 15.5% 23.3% 14.5%

Percentage of respondents saying their firms are in that size category who used each software. Some columns do not add up to 100% due to rounding.

www.thetaxadviser.com August 2022 27