Page 475 - TaxAdviser_2022

P. 475

The exclusion is calculated as a pro rata

amount of qualified education expenses

divided by the redemption proceeds. Interest earned on I bonds can be taxed

For example, if the proceeds from an I annually or deferred until redemption or

bond are redeemed for $12,000 ($6,000

principal and $6,000 interest) and the maturity. Earnings can be excluded from

qualified education expenses are $9,000, taxes completely if they are used for

then the exclusion of interest is $4,500

([$9,000 ÷ $12,000] × $6,000). Inter- qualified education expenses under

est earnings cannot be excluded for specific circumstances, and the interest

qualified expenses paid by scholarships

or other grants. The exclusion can be earnings are automatically excluded

claimed using Form 8115, Exclusion of from state and local taxes.

Interest From Series EE and I U.S. Sav-

ings Bonds Issued After 1989, which is

filed with Form 1040, U.S. Individual of the Fiscal Service Form 4000, Request in the child’s name may be under the

Income Tax Return. Qualified education to Reissue United States Savings Bonds; federal income tax threshold if the child

expenses include tuition and fees paid however, bonds should only be reissued elects to report the interest annually on a

in the year of redemption. Room, board, in the parents’ name if none of the funds tax return in his or her own SSN.

and books do not qualify. used to purchase the bonds belonged to I bonds purchased specifically for

the child. Also, interest on bonds already education purposes might best be

Stipulations apply

To be eligible for the education exclu-

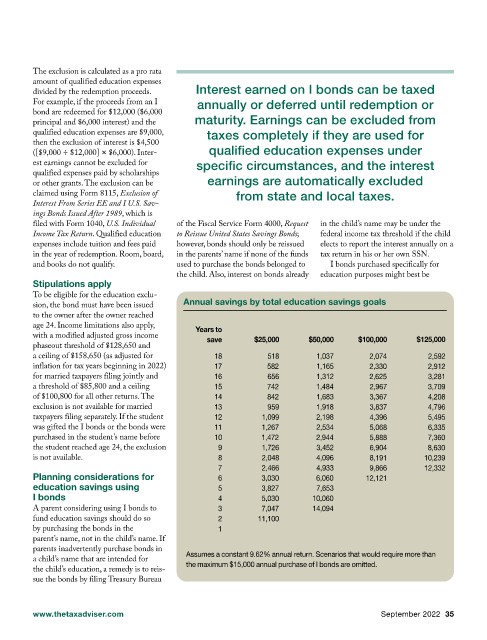

sion, the bond must have been issued Annual savings by total education savings goals

to the owner after the owner reached

age 24. Income limitations also apply,

Years to

with a modified adjusted gross income

save $25,000 $50,000 $100,000 $125,000

phaseout threshold of $128,650 and

a ceiling of $158,650 (as adjusted for 18 518 1,037 2,074 2,592

inflation for tax years beginning in 2022) 17 582 1,165 2,330 2,912

for married taxpayers filing jointly and 16 656 1,312 2,625 3,281

a threshold of $85,800 and a ceiling 15 742 1,484 2,967 3,709

of $100,800 for all other returns. The 14 842 1,683 3,367 4,208

exclusion is not available for married 13 959 1,918 3,837 4,796

taxpayers filing separately. If the student 12 1,099 2,198 4,396 5,495

was gifted the I bonds or the bonds were 11 1,267 2,534 5,068 6,335

purchased in the student’s name before 10 1,472 2,944 5,888 7,360

the student reached age 24, the exclusion 9 1,726 3,452 6,904 8,630

is not available. 8 2,048 4,096 8,191 10,239

7 2,466 4,933 9,866 12,332

Planning considerations for 6 3,030 6,060 12,121

education savings using 5 3,827 7,653

I bonds 4 5,030 10,060

A parent considering using I bonds to 3 7,047 14,094

fund education savings should do so 2 11,100

by purchasing the bonds in the 1

parent’s name, not in the child’s name. If

parents inadvertently purchase bonds in

Assumes a constant 9.62% annual return. Scenarios that would require more than

a child’s name that are intended for

the maximum $15,000 annual purchase of I bonds are omitted.

the child’s education, a remedy is to reis-

sue the bonds by filing Treasury Bureau

www.thetaxadviser.com September 2022 35