Page 476 - TaxAdviser_2022

P. 476

PERSONAL FINANCIAL PLANNING

to accumulate $100,000, again, assuming

The primary benefit of I bond savings for a constant return of 9.62%.

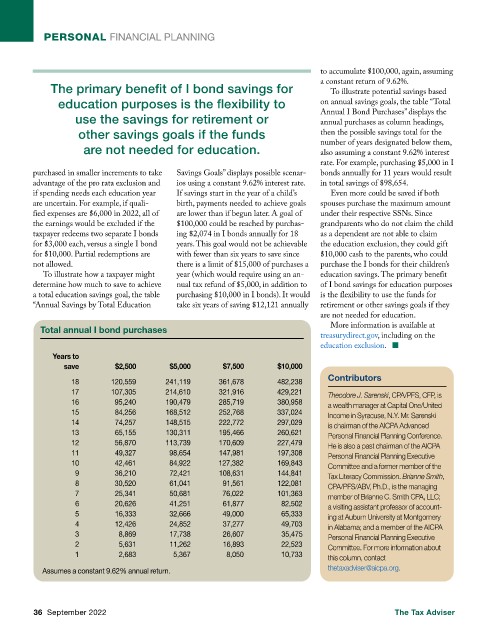

To illustrate potential savings based

education purposes is the flexibility to on annual savings goals, the table “Total

use the savings for retirement or Annual I Bond Purchases” displays the

annual purchases as column headings,

other savings goals if the funds then the possible savings total for the

are not needed for education. number of years designated below them,

also assuming a constant 9.62% interest

rate. For example, purchasing $5,000 in I

purchased in smaller increments to take Savings Goals” displays possible scenar- bonds annually for 11 years would result

advantage of the pro rata exclusion and ios using a constant 9.62% interest rate. in total savings of $98,654.

if spending needs each education year If savings start in the year of a child’s Even more could be saved if both

are uncertain. For example, if quali- birth, payments needed to achieve goals spouses purchase the maximum amount

fied expenses are $6,000 in 2022, all of are lower than if begun later. A goal of under their respective SSNs. Since

the earnings would be excluded if the $100,000 could be reached by purchas- grandparents who do not claim the child

taxpayer redeems two separate I bonds ing $2,074 in I bonds annually for 18 as a dependent are not able to claim

for $3,000 each, versus a single I bond years. This goal would not be achievable the education exclusion, they could gift

for $10,000. Partial redemptions are with fewer than six years to save since $10,000 cash to the parents, who could

not allowed. there is a limit of $15,000 of purchases a purchase the I bonds for their children’s

To illustrate how a taxpayer might year (which would require using an an- education savings. The primary benefit

determine how much to save to achieve nual tax refund of $5,000, in addition to of I bond savings for education purposes

a total education savings goal, the table purchasing $10,000 in I bonds). It would is the flexibility to use the funds for

“Annual Savings by Total Education take six years of saving $12,121 annually retirement or other savings goals if they

are not needed for education.

Total annual I bond purchases More information is available at

treasurydirect.gov, including on the

education exclusion. ■

Years to

save $2,500 $5,000 $7,500 $10,000

18 120,559 241,119 361,678 482,238 Contributors

17 107,305 214,610 321,916 429,221 Theodore J. Sarenski, CPA/PFS, CFP, is

16 95,240 190,479 285,719 380,958 a wealth manager at Capital One/United

15 84,256 168,512 252,768 337,024 Income in Syracuse, N.Y. Mr. Sarenski

14 74,257 148,515 222,772 297,029 is chairman of the AICPA Advanced

13 65,155 130,311 195,466 260,621 Personal Financial Planning Conference.

12 56,870 113,739 170,609 227,479 He is also a past chairman of the AICPA

11 49,327 98,654 147,981 197,308 Personal Financial Planning Executive

10 42,461 84,922 127,382 169,843 Committee and a former member of the

9 36,210 72,421 108,631 144,841 Tax Literacy Commission. Brianne Smith,

8 30,520 61,041 91,561 122,081 CPA/PFS/ABV, Ph.D., is the managing

7 25,341 50,681 76,022 101,363 member of Brianne C. Smith CPA, LLC;

6 20,626 41,251 61,877 82,502 a visiting assistant professor of account-

5 16,333 32,666 49,000 65,333 ing at Auburn University at Montgomery

4 12,426 24,852 37,277 49,703 in Alabama; and a member of the AICPA

3 8,869 17,738 26,607 35,475 Personal Financial Planning Executive

2 5,631 11,262 16,893 22,523 Committee. For more information about

1 2,683 5,367 8,050 10,733 this column, contact

Assumes a constant 9.62% annual return. thetaxadviser@aicpa.org.

36 September 2022 The Tax Adviser