Page 530 - TaxAdviser_2022

P. 530

DC CURRENTS

Newly released IRS Data Book

numbers confirm decline in

audit rates

Author: Along with frustrating backlogs, describing a full range of IRS activities,

Robert M. Caplan, CPA declining audit rates have been the including returns, collections, refunds,

topic of many accountant discussions enforcement, and the IRS workforce.

regarding how IRS budget constraints The recent report covers the fiscal year

have affected taxpayers. The latest ending Sept. 30, 2021. This is the first

IRS statistics confirm the declining full tax year affected by COVID-19.

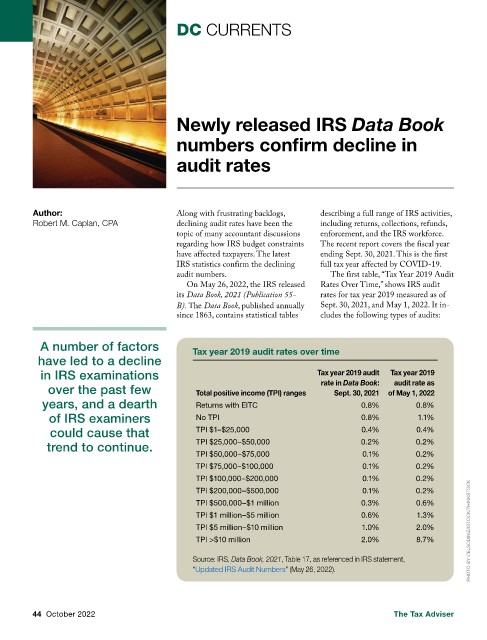

audit numbers. The first table, “Tax Year 2019 Audit

On May 26, 2022, the IRS released Rates Over Time,” shows IRS audit

its Data Book, 2021 (Publication 55- rates for tax year 2019 measured as of

B). The Data Book, published annually Sept. 30, 2021, and May 1, 2022. It in-

since 1863, contains statistical tables cludes the following types of audits:

A number of factors Tax year 2019 audit rates over time

have led to a decline

in IRS examinations Tax year 2019 audit Tax year 2019

audit rate as

over the past few Total positive income (TPI) ranges rate in Data Book: of May 1, 2022

Sept. 30, 2021

years, and a dearth Returns with EITC 0.8% 0.8%

of IRS examiners No TPI 0.8% 1.1%

could cause that TPI $1–$25,000 0.4% 0.4%

trend to continue. TPI $25,000–$50,000 0.2% 0.2%

TPI $50,000–$75,000 0.1% 0.2%

TPI $75,000–$100,000 0.1% 0.2%

TPI $100,000–$200,000 0.1% 0.2%

TPI $200,000–$500,000 0.1% 0.2%

TPI $500,000–$1 million 0.3% 0.6%

TPI $1 million–$5 million 0.6% 1.3%

TPI $5 million–$10 million 1.0% 2.0% PHOTO BY CELSODINIZ/ISTOCK/THINKSTOCK

TPI >$10 million 2.0% 8.7%

Source: IRS, Data Book, 2021, Table 17, as referenced in IRS statement,

“Updated IRS Audit Numbers” (May 26, 2022).

44 October 2022 The Tax Adviser