Page 396 - Large Business IRS Training Guides

P. 396

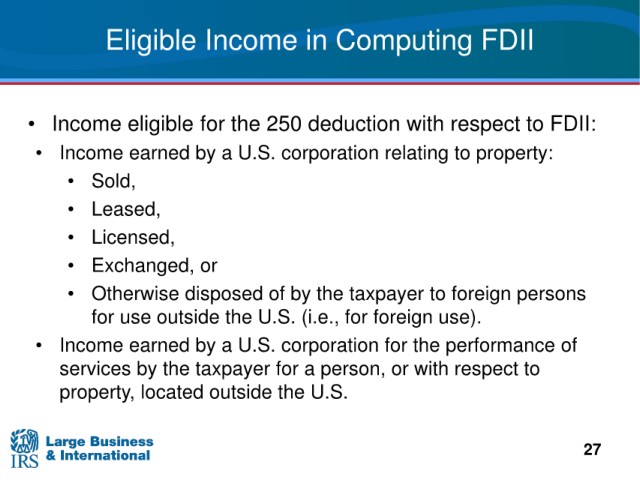

Eligible Income in Computing FDII

• Income eligible for

the 250 deduction with respect to FDII:

a U.S. corporation relating to property:

• Income earned by

• Sold,

• Leased,

• Licensed,

• Exchanged, or

to foreign persons

• Otherwise disposed of by the taxpayer

use outside the U.S. (i.e., for foreign use).

for

• Income earned by a U.S. corporation for the performance of

services by

the taxpayer for a person, or with respect to

property, located outside the U.S.

27