Page 393 - Large Business IRS Training Guides

P. 393

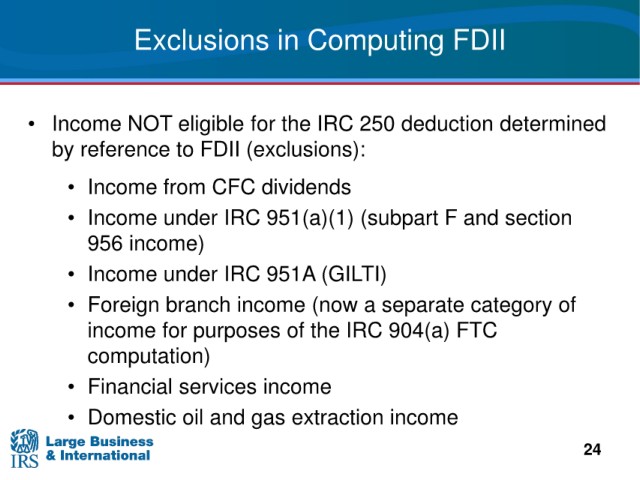

Exclusions

in Computing FDII

eligible for the IRC 250 deduction determined

• Income NOT

(exclusions):

by reference to FDII

• Income from CFC

dividends

IRC 951(a)(1) (subpart F and section

• Income under

956 income)

951A (GILTI)

• Income under IRC

• Foreign branch income (now a separate category of

income for purposes

of the IRC 904(a) FTC

computation)

• Financial

services income

• Domestic oil and gas extraction income

24