Page 388 - Large Business IRS Training Guides

P. 388

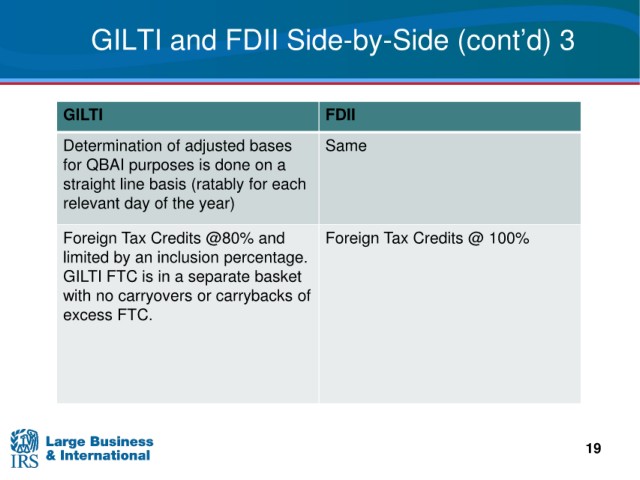

GILTI and FDII

Side-by-Side (cont’d) 3

GILTI FDII

Determination of adjusted bases Same

for QBAI

purposes is done on a

line basis (ratably for each

straight

day of the year)

relevant

Foreign Tax Foreign Tax Credits

@ 100%

Credits @80% and

an inclusion percentage.

limited by

FTC is in a separate basket

GILTI

with no

carryovers or carrybacks of

excess FTC.

19