Page 385 - Large Business IRS Training Guides

P. 385

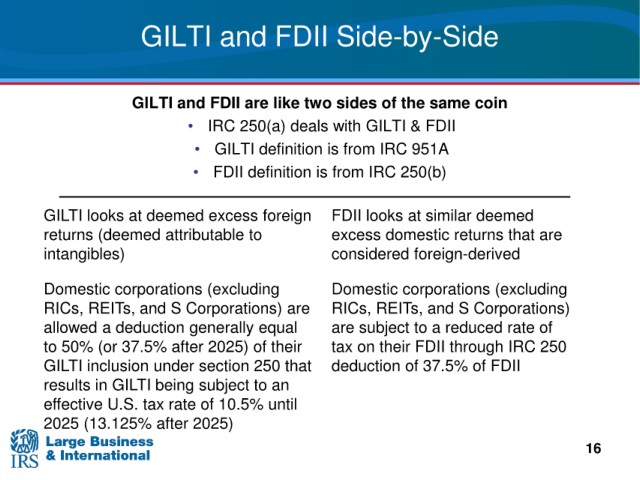

GILTI and FDII

Side-by-Side

GILTI and FDII are like two sides of the same coin

deals with GILTI & FDII

• IRC 250(a)

• GILTI

definition is from IRC 951A

definition is from IRC 250(b)

• FDII

GILTI

looks at deemed excess foreign FDII looks at similar deemed

returns (deemed attributable to excess

domestic returns that are

intangibles) considered foreign-derived

Domestic corporations (excluding Domestic corporations (excluding

RICs, RICs,

REITs, and S Corporations) are

REITs, and S Corporations)

to a reduced rate of

equal

allowed a deduction generally are subject

on their FDII through IRC 250

after 2025) of their

to 50% (or 37.5% tax

GILTI

inclusion under section 250 that deduction of 37.5% of FDII

results in GILTI

being subject to an

effective U.S. tax rate of 10.5%

until

2025 (13.125% after

2025)

16