Page 382 - Large Business IRS Training Guides

P. 382

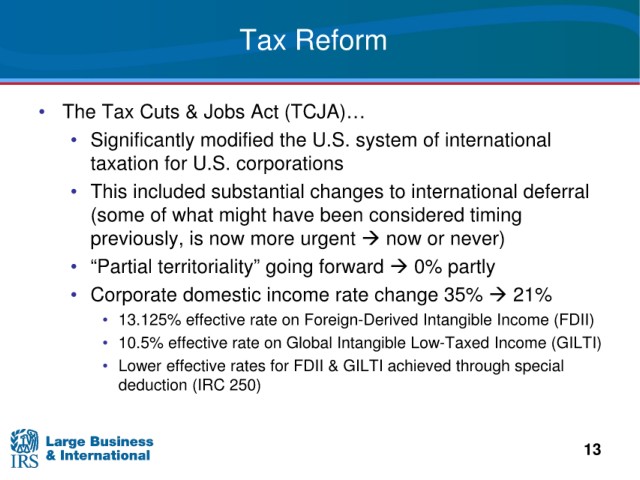

Tax

Reform 1

• The Tax

Cuts & Jobs Act (TCJA)…

• Significantly

modified the U.S. system of international

U.S. corporations

taxation for

• This included substantial changes to international deferral

(some of what might have been considered timing

previously, is now more urgent now or never)

• “Partial territoriality” going forward 0% partly

• Corporate domestic income rate change 35% 21%

• 13.125%

effective rate on Foreign-Derived Intangible Income (FDII)

• 10.5%

effective rate on Global Intangible Low-Taxed Income (GILTI)

• Lower

effective rates for FDII & GILTI achieved through special

deduction (IRC 250)

13