Page 386 - Large Business IRS Training Guides

P. 386

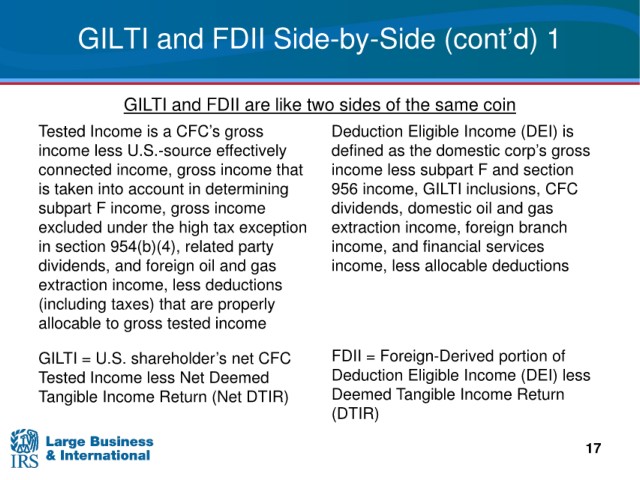

GILTI and FDII

Side-by-Side (cont’d) 1

GILTI

and FDII are like two sides of the same coin

Tested Income is a CFC’s gross Deduction Eligible Income (DEI) is

U.S.-source effectively

the domestic corp’s gross

income less defined as

connected income, gross income less

income that

subpart F and section

is taken into account in determining 956 income,

GILTI inclusions, CFC

income, gross income

subpart F dividends,

domestic oil and gas

the high tax exception

excluded under extraction income, foreign branch

in section 954(b)(4), related party income,

and financial services

less allocable deductions

and foreign oil and gas

dividends, income,

extraction income, less

deductions

that are properly

(including taxes)

allocable to gross tested income

Foreign-Derived portion of

GILTI = FDII =

U.S. shareholder’s net CFC

Tested Income less Net Deemed Deduction Eligible Income (DEI) less

Tangible Income Return (Net DTIR) Deemed Tangible Income Return

(DTIR)

17