Page 389 - Large Business IRS Training Guides

P. 389

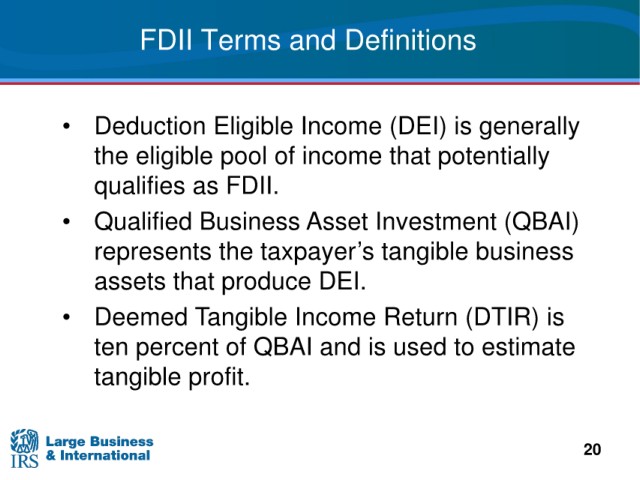

FDII

Terms and Definitions 1

• Deduction Eligible Income (DEI) is generally

the eligible pool

of income that potentially

qualifies as FDII.

• Qualified Business Asset Investment (QBAI)

represents the taxpayer’s tangible business

assets that produce DEI.

• Deemed Tangible Income Return (DTIR) is

of QBAI and is used to estimate

ten percent

tangible profit.

20