Page 387 - Large Business IRS Training Guides

P. 387

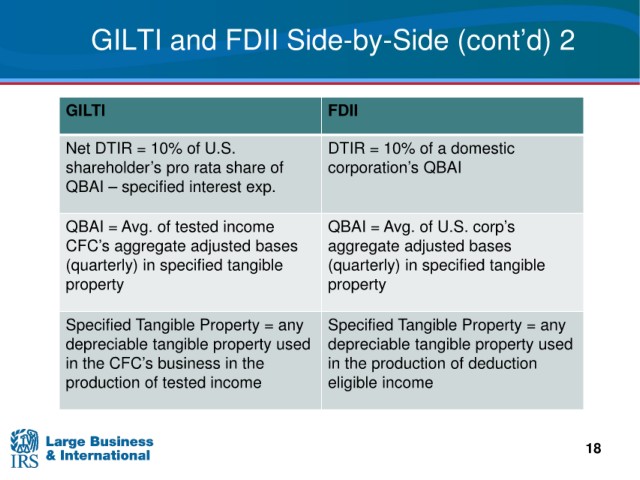

GILTI and FDII

Side-by-Side (cont’d) 2

GILTI FDII

Net DTIR =

DTIR = 10% of U.S.

10% of a domestic

shareholder’s corporation’s

QBAI

pro rata share of

– specified interest exp.

QBAI

Avg. of tested income

Avg. of U.S. corp’s

QBAI = QBAI =

CFC’s aggregate adjusted bases aggregate adjusted bases

(quarterly) (quarterly)

in specified tangible

in specified tangible

property property

any

Specified Tangible Property = Specified Tangible Property =

any

depreciable tangible property used depreciable tangible property used

in the CFC’s business in the in the production of deduction

production of eligible income

tested income

18