Page 401 - Large Business IRS Training Guides

P. 401

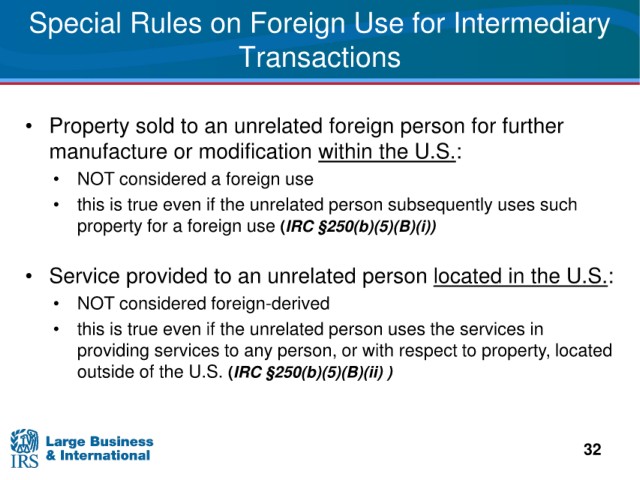

Special

Rules on Foreign Use for Intermediary

Transactions

• Property sold to an unrelated foreign person for further

manufacture or modification within the U.S.:

considered a foreign use

• NOT

true even if the unrelated person subsequently uses such

• this i s

property

for a foreign use (IRC §250(b)(5)(B)(i))

• Service provided to an unrelated person located in the U.S.:

considered foreign-derived

• NOT

• this i s

true even if the unrelated person uses the services in

to any person, or with respect to property, located

providing services

outside of

the U.S. (IRC §250(b)(5)(B)(ii) )

32