Page 406 - Large Business IRS Training Guides

P. 406

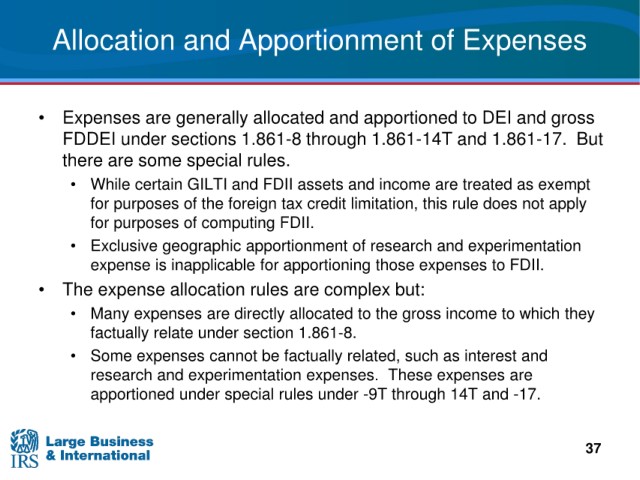

Allocation and Apportionment

of Expenses

are generally allocated and apportioned to DEI and gross

• Expenses

under sections 1.861-8 through 1.861-14T and 1.861-17.

FDDEI But

rules.

there are some special

• While certain GILTI

and FDII assets and income are treated as exempt

for purposes

of the foreign tax credit limitation, this rule does not apply

for purposes

of computing FDII.

• Exclusive geographic

apportionment of research and experimentation

inapplicable for apportioning those expenses to FDII.

expense is

• The expense allocation rules

are complex but:

• Many

expenses are directly allocated to the gross income to which they

relate under section 1.861-8.

factually

• Some expenses

cannot be factually related, such as interest and

These expenses are

research and experimentation expenses.

special rules under -9T through 14T and -17.

apportioned under

37