Page 409 - Large Business IRS Training Guides

P. 409

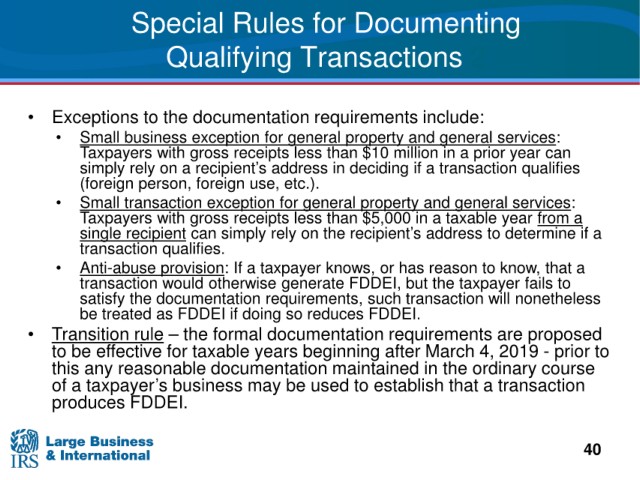

Special Rules for Documenting

Qualifying Transactions

2

• Exceptions

to the documentation requirements include:

business exception for general property and general services:

• Small

Taxpayers

with gross receipts less than $10 million in a prior year can

rely on a recipient’s address in deciding if a transaction qualifies

simply

etc.).

(foreign person, foreign use,

• Small transaction exception for general property and general services:

Taxpayers with gross receipts less than $5,000 in a taxable year from a

single recipient can simply rely on the recipient’s address to determine if a

transaction qualifies.

• Anti-abuse provision: If a taxpayer knows, or has reason to know, that a

transaction would otherwise generate FDDEI, but the taxpayer fails to

satisfy the documentation requirements, such transaction will nonetheless

be treated as FDDEI if doing so reduces FDDEI.

• Transition rule – the formal documentation requirements are proposed

to be effective for taxable years beginning after March 4, 2019 - prior to

this any reasonable documentation maintained in the ordinary course

of a taxpayer’s business may be used to establish that a transaction

produces FDDEI.

40