Page 411 - Large Business IRS Training Guides

P. 411

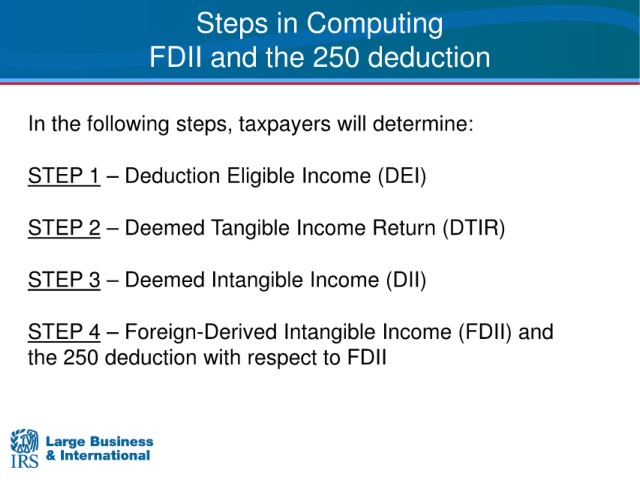

Steps

in Computing

FDII and the 250 deduction

In the following steps,

taxpayers will determine:

STEP 1 – Deduction Eligible Income (DEI)

STEP 2 – Deemed Tangible Income Return (DTIR)

STEP 3 – Deemed Intangible Income (DII)

STEP 4 – Foreign-Derived Intangible Income (FDII) and

the 250 deduction with respect to FDII

42