Page 412 - Large Business IRS Training Guides

P. 412

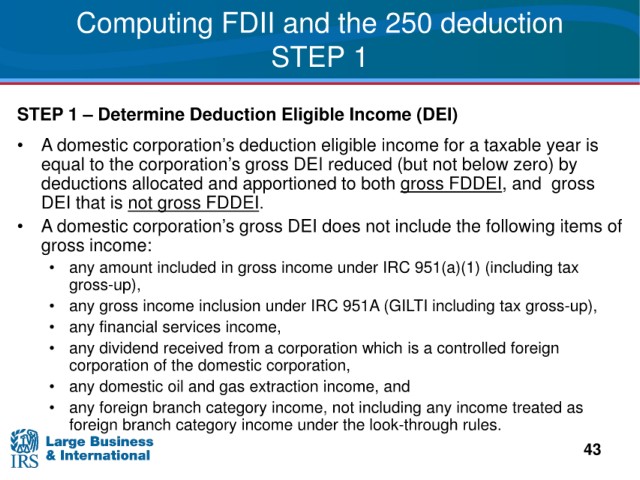

Computing FDII and the 250 deduction

STEP 1

– Determine Deduction Eligible Income (DEI)

STEP 1

• A domestic corporation’s deduction eligible income for a taxable year is

equal to the corporation’s gross DEI reduced (but not below zero) by

deductions allocated and apportioned to both gross FDDEI, and gross

DEI that is not gross FDDEI.

• A domestic corporation’s gross DEI does not include the following items of

income:

gross

amount included in gross income under IRC 951(a)(1) (including tax

• any

gross-up),

gross income inclusion under IRC 951A (GILTI including tax gross-up),

• any

financial services income,

• any

dividend received from a corporation which is a controlled foreign

• any

the domestic corporation,

corporation of

domestic oil and gas extraction income, and

• any

foreign branch category income, not including any income treated as

• any

income under the look-through rules.

foreign branch category

43