Page 402 - Large Business IRS Training Guides

P. 402

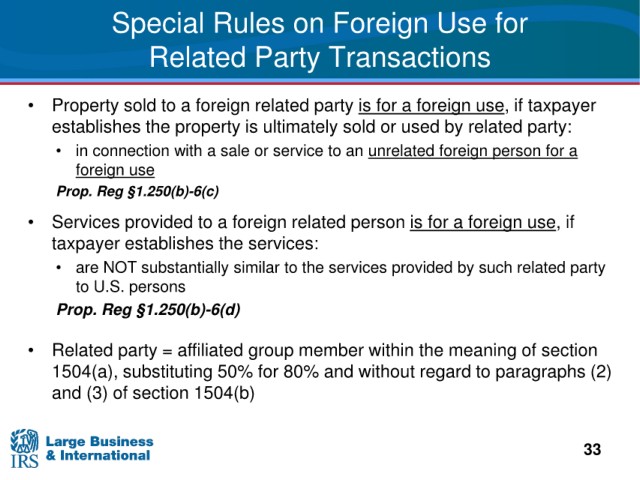

Special

Rules on Foreign Use for

Related Party

Transactions

• Property

sold to a foreign related party is for a foreign use, if taxpayer

the property is ultimately sold or used by related party:

establishes

• in connection with a sale or service to an unrelated foreign person for

a

foreign use

Prop. Reg §1.250(b)-6(c)

• Services

provided to a foreign related person is for a foreign use, if

taxpayer

establishes the services:

• are NOT

substantially similar to the services provided by such related party

persons

to U.S.

Prop.

Reg §1.250(b)-6(d)

affiliated group member within the meaning of section

• Related party =

substituting 50% for 80% and without regard to paragraphs (2)

1504(a),

and (3)

of section 1504(b)

33