Page 403 - Large Business IRS Training Guides

P. 403

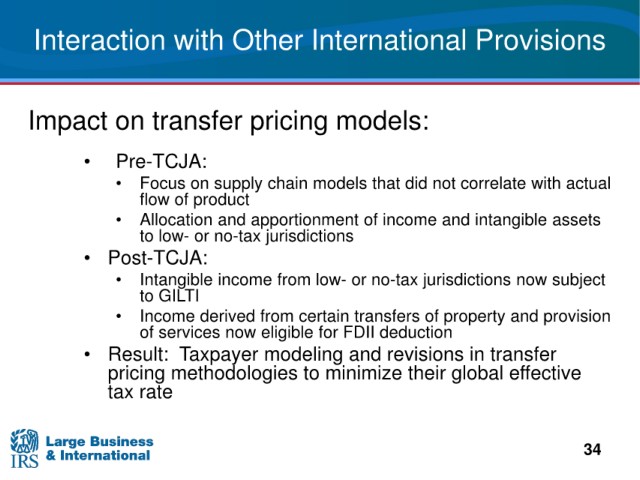

Interaction with Other

International Provisions

on transfer pricing models:

Impact

• Pre-TCJA:

• Focus on supply

chain models that did not correlate with actual

flow

of product

of income and intangible assets

• Allocation and apportionment

to low- or no-tax jurisdictions

• Post-TCJA:

low- or no-tax jurisdictions now subject

• Intangible income from

to GILTI

certain transfers of property and provision

• Income derived from

services now eligible for FDII deduction

of

modeling and revisions in transfer

• Result: Taxpayer

pricing methodologies to minimize their global effective

tax rate

34