Page 436 - Large Business IRS Training Guides

P. 436

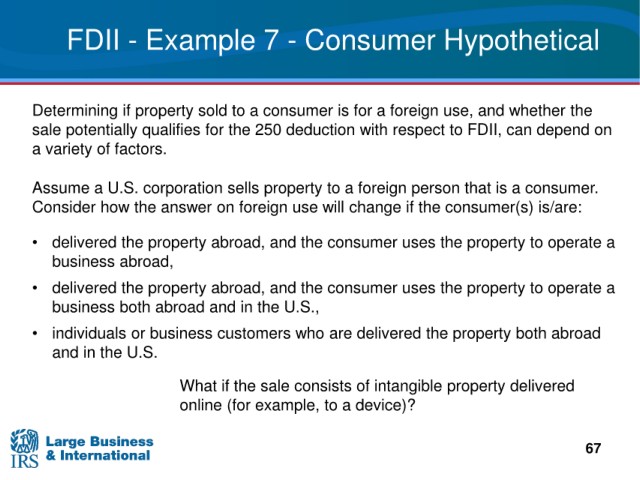

FDII - Example 7 - Consumer Hypothetical

sold to a consumer is for a foreign use, and whether the

Determining if property

qualifies for the 250 deduction with respect to FDII, can depend on

sale potentially

of factors.

a variety

Assume a U.S. corporation sells

property to a foreign person that is a consumer.

Consider

how the answer on foreign use will change if the consumer(s) is/are:

• delivered the property

abroad, and the consumer uses the property to operate a

business abroad,

abroad, and the consumer uses the property to operate a

• delivered the property

business both abroad and in the U.S.,

• individuals

or business customers who are delivered the property both abroad

and in the U.S.

What if

the sale consists of intangible property delivered

online (for

example, to a device)?

67