Page 437 - Large Business IRS Training Guides

P. 437

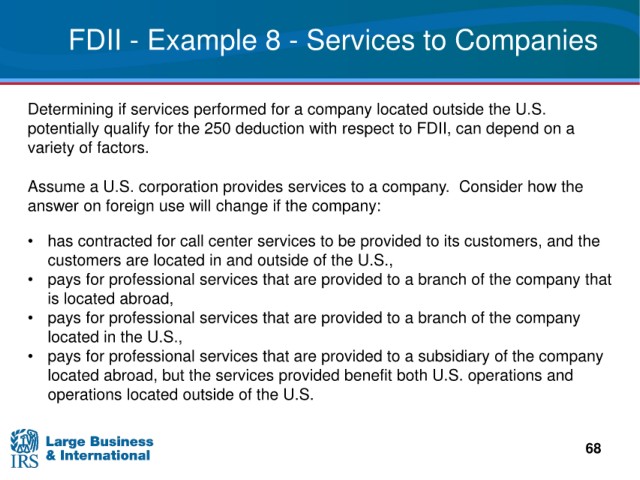

FDII - Example 8 - Services to Companies

located outside the U.S.

Determining if services performed for a company

qualify for the 250 deduction with respect to FDII, can depend on a

potentially

of factors.

variety

Assume a U.S. corporation provides Consider how the

services to a company.

answer on foreign use will change if the company:

• has contracted for call center

services to be provided to its customers, and the

customers are located in and outside of the U.S.,

for professional services that are provided to a branch of the company that

• pays

is located abroad,

for professional services that are provided to a branch of the company

• pays

located in the U.S.,

for professional services that are provided to a subsidiary of the company

• pays

located abroad, but the services provided benefit both U.S. operations and

located outside of the U.S.

operations

68