Page 29 - TaxAdviser_Jan_Apr23_Neat

P. 29

trusts would not be a distribution for losses and credit carryforwards and Trust’s modification does not

purposes of Secs. 661 and 662. statutory depletion deductions. Each lose its GST tax-exempt status

2. The pro rata transfer of assets from asset transferred to the newly cre- In IRS Letter Ruling 202206008 re-

the original trust to the newly created ated trusts would have the same tax leased Feb. 11, 2022, the IRS ruled that

trusts would not result in the real- attributes immediately after the divi- trust modifications under a settlement

ization of any income, gain, or loss sion that it had immediately before agreement creating a formula testamen-

under Sec. 61 or Sec. 1001. the division. tary general power of appointment in

3. The newly created trusts would be 7. The GST tax-exempt status of the one of the trust’s beneficiaries would

treated as separate trusts for federal original trust would not be affected not result in the loss of the trust’s GST

income tax purposes pursuant to Sec. by the division. tax-exempt status and would result in

643(f). The IRS has previously ruled favor- only the trust property subject to the

4. The tax basis that the newly created ably in all of the above rulings on the beneficiary’s general power of appoint-

trusts would have in the assets of the division or severance of a trust except ment being included in the beneficiary’s

original trust after the division would Ruling No. 6. Although not stated in gross estate.

be the same as their tax basis in the this ruling request, the premise for these A parent’s will left the remainder

original trust. rulings is that the IRS has opined that of the parent’s estate to two trusts,

5. Each asset of the original trust would the division or severance of a trust — at Trust A and Trust B. Trust B was the

have the same holding period after least, if accomplished during the same subject of the ruling request. Regarding

the transfer that the asset had before tax year — is a continuation of the the administration of Trust B, the will

the division. old trust (except maybe Ruling No. provided that all of the net income was

6. On the division of the original trust 3, which requests that the resulting to be distributed to the parent’s child

into the newly created trusts, each trusts be treated as separate trusts).³ (Child) during Child’s life. Regarding

of the newly created trusts would Although the Service does not provide Trust B’s corpus, the trustee had the

succeed to and take into account an any analysis for Ruling No. 6, this rul- discretion to make distributions as the

equal portion of any net operating ing is consistent with the IRS’s opinion trustee deemed necessary for the main-

loss carryforward, net capital loss, that the trusts resulting from a division tenance, education, welfare, and comfort

and other tax attributes of the origi- or severance are a continuation of the of any of the trust’s beneficiaries. Upon

nal trust, including passive activity old trust. Child’s death, Trust B was to terminate

3. See, e.g., IRS Letter Ruling 200736002.

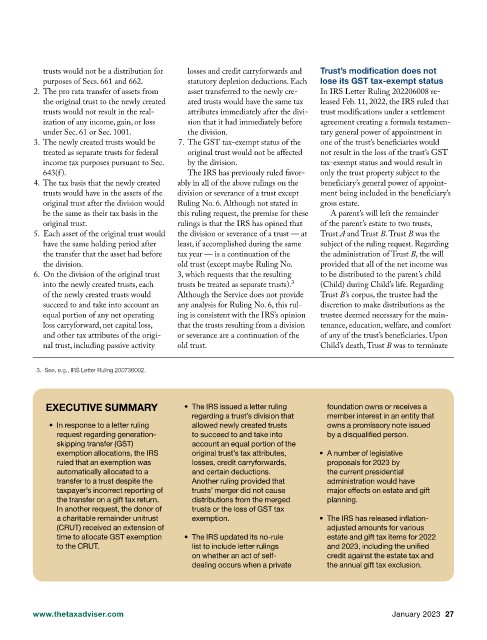

EXECUTIVE SUMMARY • The IRS issued a letter ruling foundation owns or receives a

regarding a trust’s division that member interest in an entity that

• In response to a letter ruling allowed newly created trusts owns a promissory note issued

request regarding generation- to succeed to and take into by a disqualified person.

skipping transfer (GST) account an equal portion of the

exemption allocations, the IRS original trust’s tax attributes, • A number of legislative

ruled that an exemption was losses, credit carryforwards, proposals for 2023 by

automatically allocated to a and certain deductions. the current presidential

transfer to a trust despite the Another ruling provided that administration would have

taxpayer’s incorrect reporting of trusts’ merger did not cause major effects on estate and gift

the transfer on a gift tax return. distributions from the merged planning.

In another request, the donor of trusts or the loss of GST tax

a charitable remainder unitrust exemption. • The IRS has released inflation-

(CRUT) received an extension of adjusted amounts for various

time to allocate GST exemption • The IRS updated its no-rule estate and gift tax items for 2022

to the CRUT. list to include letter rulings and 2023, including the unified

on whether an act of self- credit against the estate tax and

dealing occurs when a private the annual gift tax exclusion.

www.thetaxadviser.com January 2023 27